-

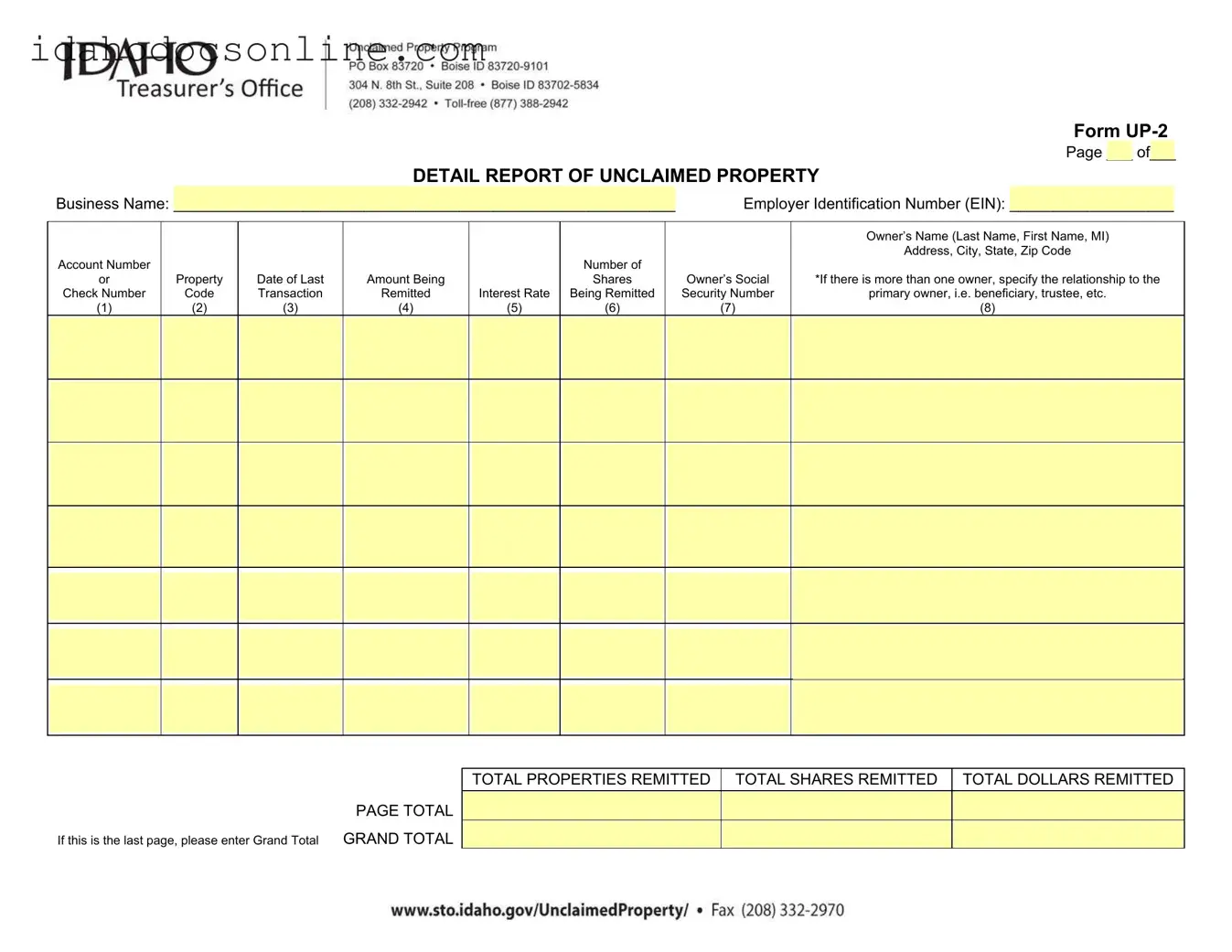

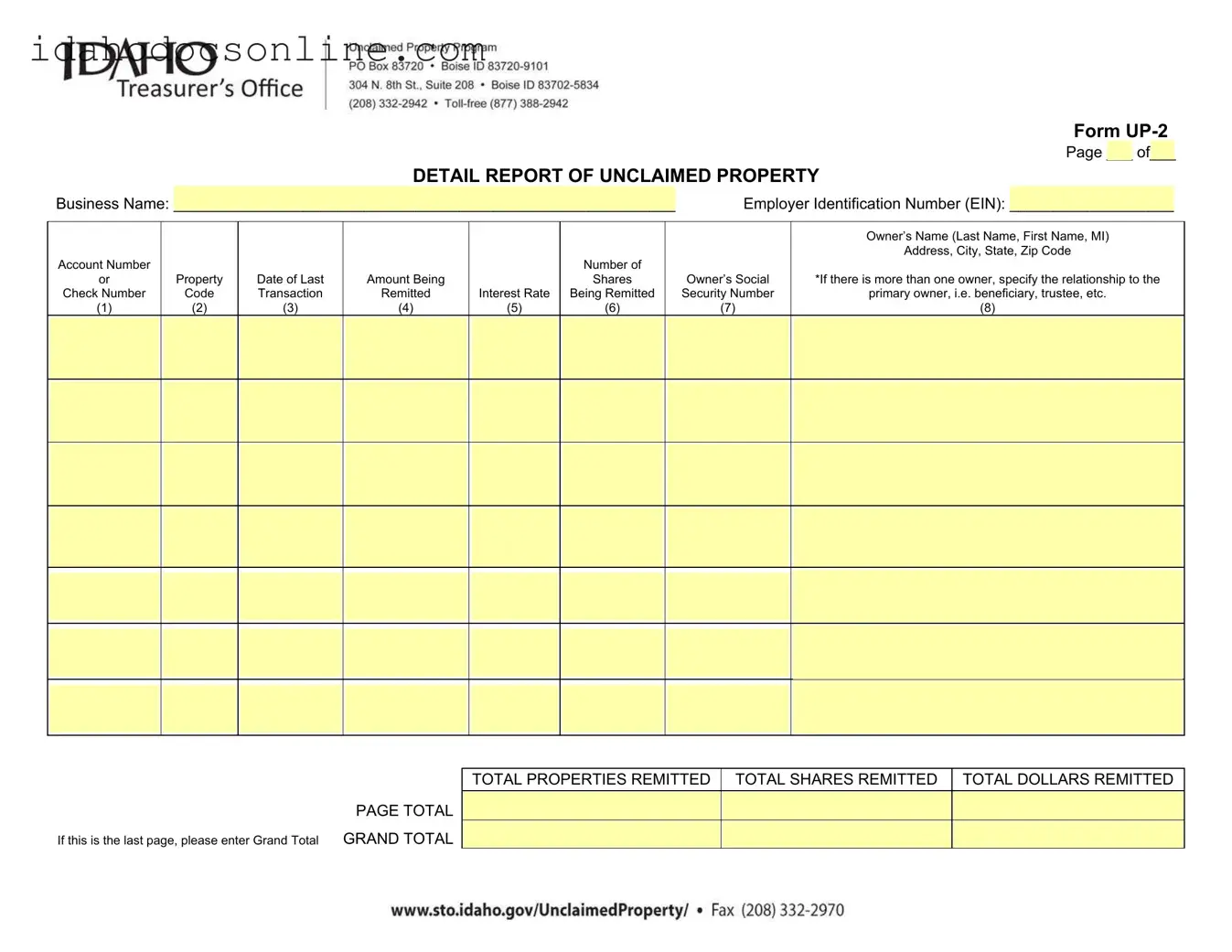

What is the Up2 Idaho form?

The Up2 Idaho form is used to report unclaimed property in the state of Idaho. Businesses and organizations must complete this form to remit unclaimed funds or property to the state. This includes money from accounts that have been inactive for a certain period, as well as other types of unclaimed assets.

-

Who needs to file the Up2 Idaho form?

Any business or organization that holds unclaimed property must file the Up2 Idaho form. This includes corporations, partnerships, and non-profits. If you have unclaimed funds or property that belongs to individuals, you are required to report it.

-

What information is required on the form?

The form requires several pieces of information, including:

- Business Name

- Employer Identification Number (EIN)

- Account or Check Number

- Property Code

- Date of Last Transaction

- Amount Being Remitted

- Number of Shares

- Interest Rate Being Remitted

- Owner’s Social Security Number

- Owner’s Name and Address

If there are multiple owners, the relationship to the primary owner must also be specified.

-

What happens if I don’t file the form?

Failure to file the Up2 Idaho form can result in penalties. The state may impose fines or take legal action against businesses that do not comply with reporting requirements. It is important to file on time to avoid these consequences.

-

How do I determine if property is unclaimed?

Property is considered unclaimed if there has been no activity for a specified period, which varies by property type. Common examples include inactive bank accounts, uncashed checks, and unclaimed insurance benefits. Review your records to identify any accounts that have not had transactions for a long time.

-

What is the deadline for filing the Up2 Idaho form?

The deadline for filing the Up2 Idaho form is typically November 1st each year. However, it is advisable to check for any updates or changes to the deadline. Filing on time ensures compliance with state laws.

-

Can I file the form electronically?

Yes, the Up2 Idaho form can often be filed electronically. Check the Idaho State Treasurer’s website for specific instructions on electronic filing options. Electronic submission may streamline the process and provide confirmation of your filing.

-

What should I do if I need assistance completing the form?

If you need help with the Up2 Idaho form, consider consulting a professional who specializes in unclaimed property reporting. You can also refer to resources provided by the Idaho State Treasurer’s office for guidance.

-

What is included in the total amounts reported on the form?

The form requires you to report total properties remitted, total shares remitted, and total dollars remitted. Make sure to calculate these amounts accurately. If this is the last page of your submission, you will also need to provide a grand total.

-

Is there a fee for filing the Up2 Idaho form?

There is generally no fee for filing the Up2 Idaho form itself. However, businesses should be aware of any potential costs related to preparing the form or seeking professional assistance. Always verify with the Idaho State Treasurer’s office for the most current information.