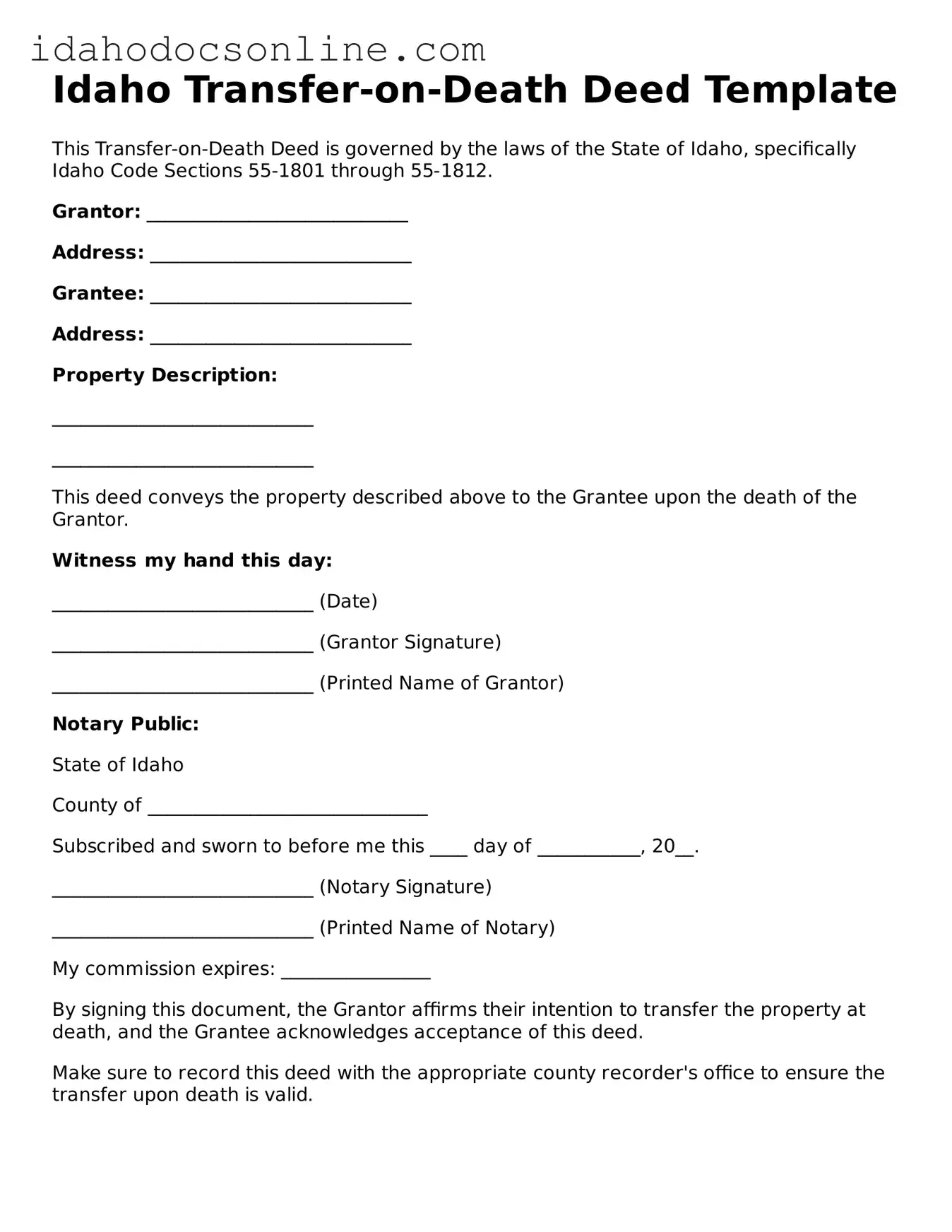

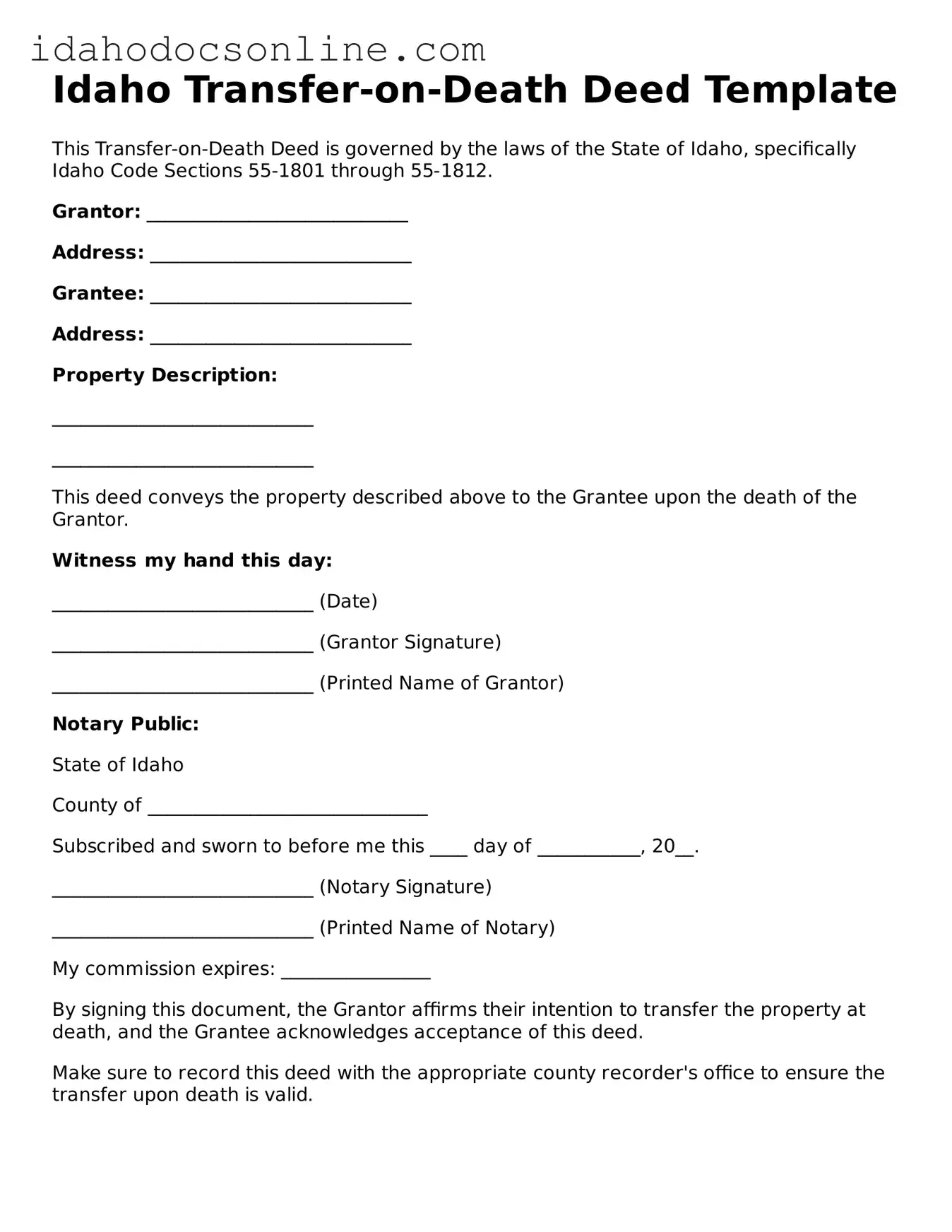

Free Transfer-on-Death Deed Form for Idaho

A Transfer-on-Death Deed in Idaho allows property owners to designate a beneficiary who will automatically receive their property upon the owner's death, avoiding the lengthy probate process. This simple yet effective tool ensures your wishes are honored without unnecessary complications. Ready to secure your property for your loved ones? Fill out the form by clicking the button below.

Fill Out Your Document

Free Transfer-on-Death Deed Form for Idaho

Fill Out Your Document

Need speed? Complete the form now

Complete Transfer-on-Death Deed online — edit, save, download with ease.

Fill Out Your Document

or

Free PDF