|

resale can buy goods that are directly and primarily used in the |

Production Equipment: A contractor who installs production equipment for |

|

production process without paying tax. Loggers, publishers of |

a producer/manufacturer can buy the materials for the production |

|

free newspapers (with at least 10% editorial content) and |

equipment exempt from tax. |

This exemption does not apply to materials |

|

broadcasters are granted a similar |

exemption. However, a |

that become part of real property. |

|

seller must charge these buyers sales tax on any of the |

|

|

|

|

following: |

|

|

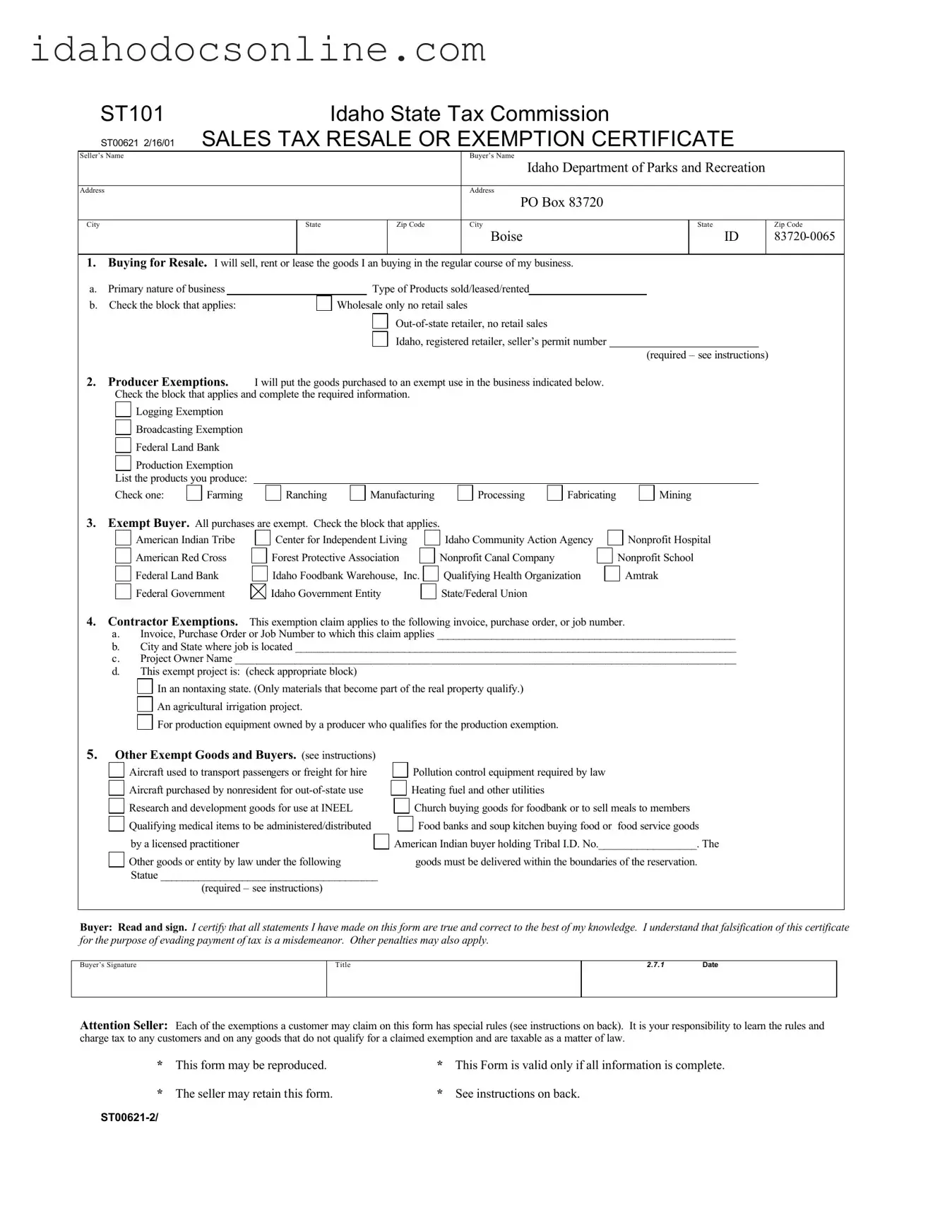

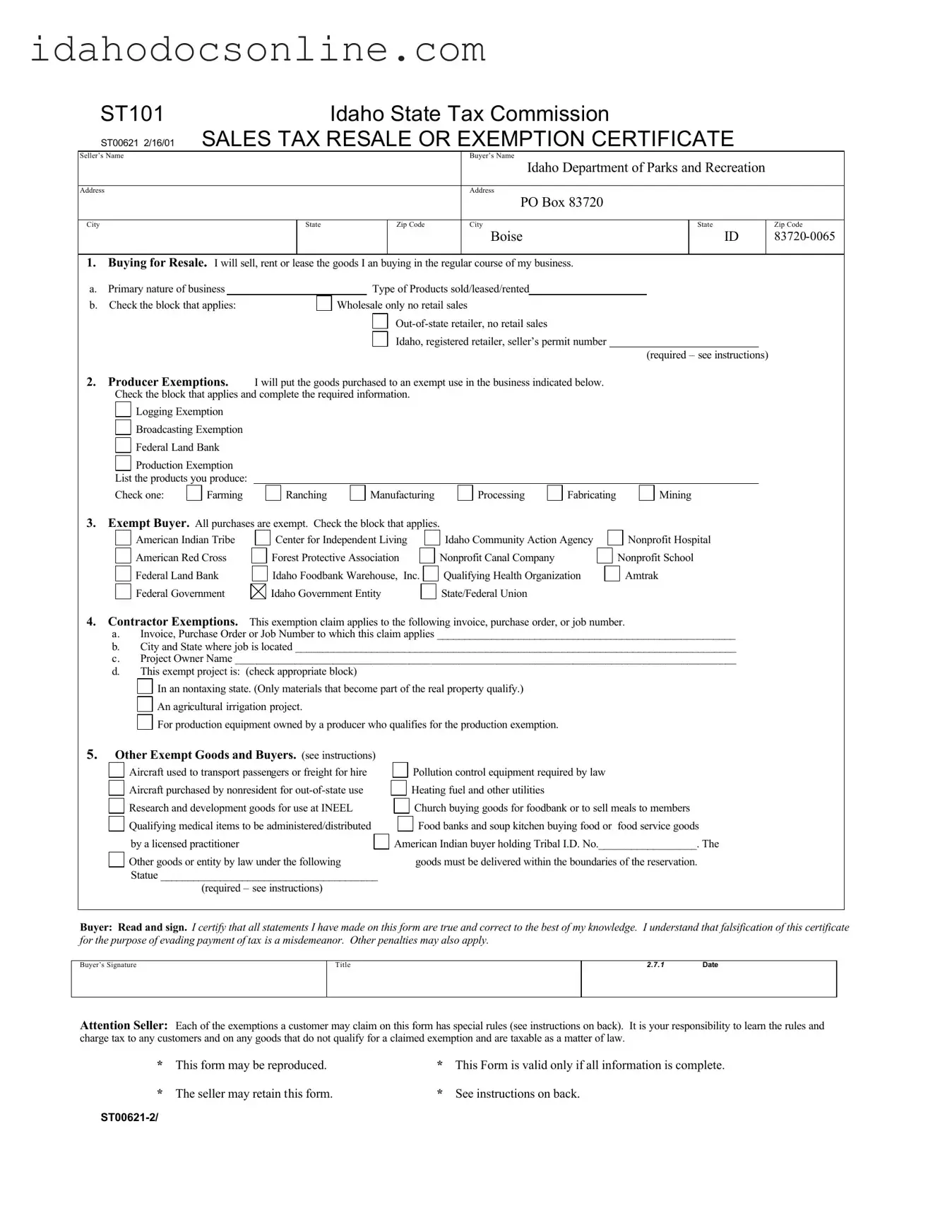

5. Other Exempt Goods and Buyers: If a buyer claims an exempt that is |

|

A hand tool with a unit cost of $100 or less |

not listed on this form, he should mark the “other” block and must list |

|

Transportation equipment and supplies |

the section of the law under which he is claiming the exemption or the |

|

Research equipment and supplies |

certificate is not valid. |

|

|

Goods used in selling/distribution |

|

|

|

|

|

Janitorial or cleaning equipment or supplies |

Aircraft Used to Transport Passengers or Freight for Hire: Only aircrafts |

|

Maintenance or repair equipment and supplies |

purchased by an airline, charter service, air ambulance service, or freight |

|

Office equipment and supplies |

|

companies qualify. |

Parts and supplies are taxable. Examples of aircrafts |

|

Any licensed motor vehicle or trailer and parts |

that don’t qualify for this exemption are those used for recreational flights, |

|

Aircraft and parts |

|

aerial spraying, dumping, or logging. |

|

Recreation vehicle |

|

|

|

|

|

Goods that become improvements to real property (such as |

Aircraft Purchased by Nonresidents for Out-of-State Use: An aircraft sold to |

fence posts) |

|

|

a nonresident is exempt if it will be immediately removed from Idaho and |

|

|

|

|

registered in another State, and will not be stored or used in Idaho for more |

NOTE TO SELLER: |

You may stamp or imprint a Producer Exemption |

than 90 days in any 12-month period. Aircraft kits and hang gliders do not |

Claim on the front of your invoice. If a customer fills in his exemption |

qualify for this exemption. |

|

claim on a stamped or imprinted statement each time you make an |

|

|

|

exempt sale to him, you do not have to keep a Form ST-101 on file for |

A business is “nonresidential” if it has no business presence in Idaho. A |

the customer. |

Contact any Tax Commission Office to obtain the |

business with property in Idaho, or employees working here, does not |

required language for the statement. |

|

qualify for this exemption. |

|

3. |

Exempt Buyers: These buyers are exempt from tax on all |

Pollution Control Equipment: |

Equipment required by a State or Federal |

|

purchases. |

|

Agency and “dry to dry transfer systems” used by the Dry Cleaning Industry |

|

|

|

|

qualify. Chemicals and supplies used for pollution control do not qualify. |

Hospitals: Only licensed nonprofit hospitals qualify. Nursing Homes |

Equipment for licensed motor vehicles does not qualify. |

or similar institutions do not. |

|

|

|

|

|

|

|

|

Research and Development at INEEL: Only goods that are directly and |

Schools: Only nonprofit colleges, universities, primary and secondary |

primarily used in research, development, experimental, and testing activities |

schools qualify. |

Schools primarily teaching subjects like business, |

at the Idaho National Engineering and Environmental Laboratory qualify. |

dancing, dramatics, music, cosmetology, writing, and gymnastics do |

Items that become a part of real property do not qualify. |

not |

qualify. |

Auxiliary organizations, such as parent-teacher |

|

|

|

associations and alumni groups, do not qualify. |

Medical Items: Only the following medical goods qualify if they will be |

|

|

|

|

administered or distributed by a licensed practitioner; drugs, oxygen, insulin, |

Centers For Independent Living: Only nonresidential centers run by |

syringes, prosthetic devices, durable medical equipment, dental prosthesis, |

disabled persons that provide the independent living programs to |

orthopedic devices, urinary and colostomy supplies, enteral and parenteral |

people with various disabilities qualify. |

|

feeding equipment and supplies, hemodyalisis and peritoneal dialysis drugs |

|

|

|

|

and supplies, and chemicals and equipment used to test or monitor blood or |

Qualifying Health Organizations: Only these qualify - - |

urine of a diabetic. |

|

|

American Cancer Society |

Idaho Ronald McDonald |

|

|

|

House |

|

|

Heating Fuels: Heating fuels such as wood, coal, petroleum, propane, and |

American Diabetes Association |

Idaho Women’s and |

natural gas are exempt when purchased to heat an enclosed building under |

Children’s |

|

|

construction, or when used for cooking or water heating. |

American Lung Association of Idaho |

Alliance |

|

|

|

American Heart Association |

March of Dimes |

Church: A church may buy food to sell meals to its members or qualifying |

The Arc, Inc. |

|

Mental Health |

goods for its food bank without paying tax. Churches must pay tax on all |

Association |

|

|

other goods they buy to use. |

|

Children’s Home Society of Idaho |

Muscular Dystrophy |

|

|

|

Foundation |

|

|

Food Banks and Soup kitchens: Food banks and soup kitchens may buy |

Arthritis Foundation |

National Multiple |

food or other goods used to grow, store, prepare, or serve the food exempt |

Sclerosis Society |

|

from sales tax. This exemption does not include licensed motor vehicles or |

Easter Seals |

|

Rocky Mountain Kidney |

trailers. |

|

|

Association |

|

|

|

|

|

Idaho Cystic Fibrosis Foundation |

Special Olympics Idaho |

American Indians: |

Sales to an enrolled Indian Tribal Member are exempt if |

Idaho Diabetes Youth Program |

United Cerebral Palsy |

the seller delivers the goods to him within the Reservation boundaries. The |

Idaho Epilepsy League |

|

buyer’s Tribal Identification Number is required. |

Idaho Primary Care Association |

|

|

|

|

and it’s Community Health Centers |

|

Ski Resorts: The owner or operator of a downhill ski area with an aerial |

|

|

|

|

passenger tramway may buy parts, materials and equipment that become a |

Government: Only the Federal government and Idaho State, County |

component part of the tramway and snow grooming and snowmaking |

or City government qualifies. Sales to other States and their political |

equipment for the slope exempt from tax. An aerial tramway includes chair |

subdivisions are taxable. |

|

lifts, gondolas, T-bar and J-bar lifts, platter lifts, rope tows, and similar |

|

|

|

|

devices. |

|

|