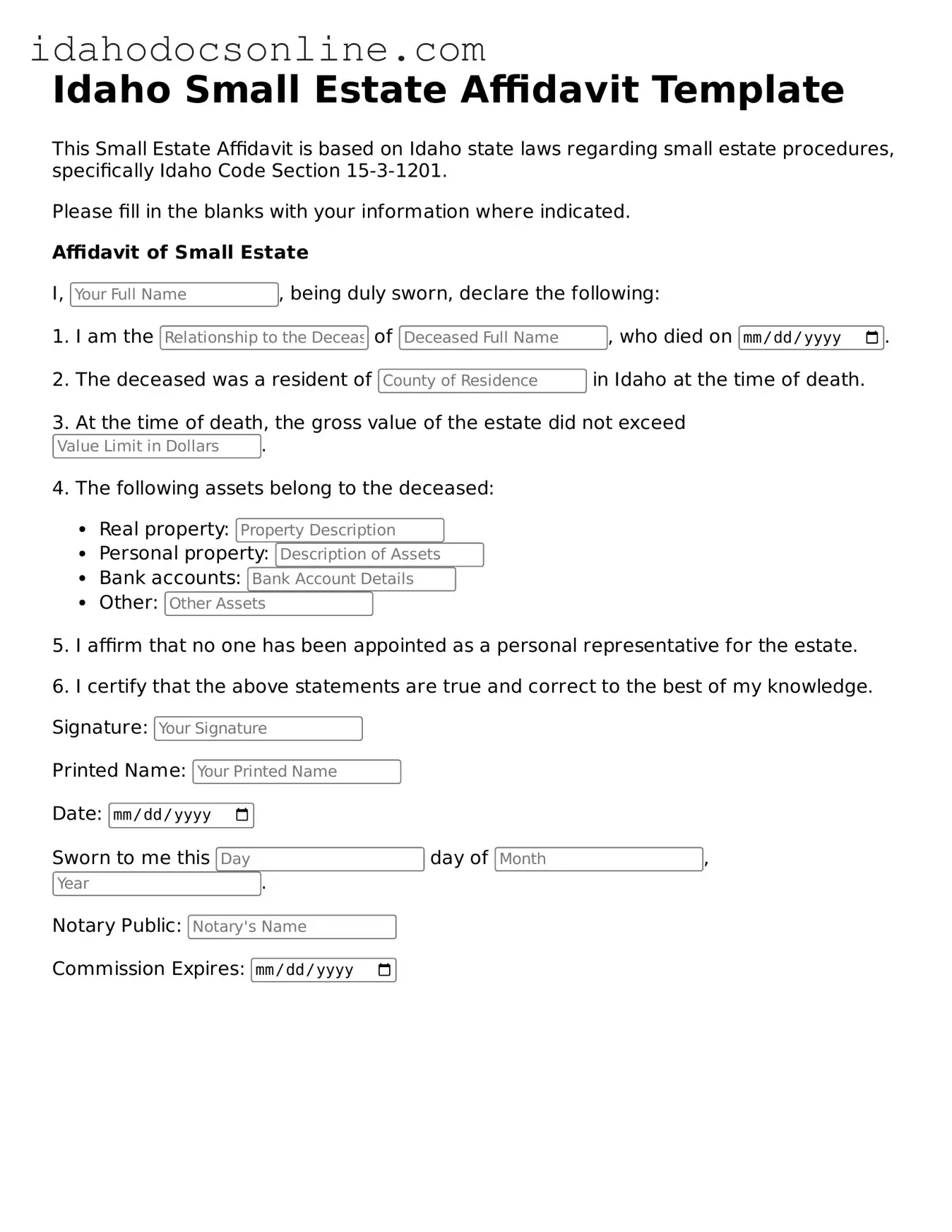

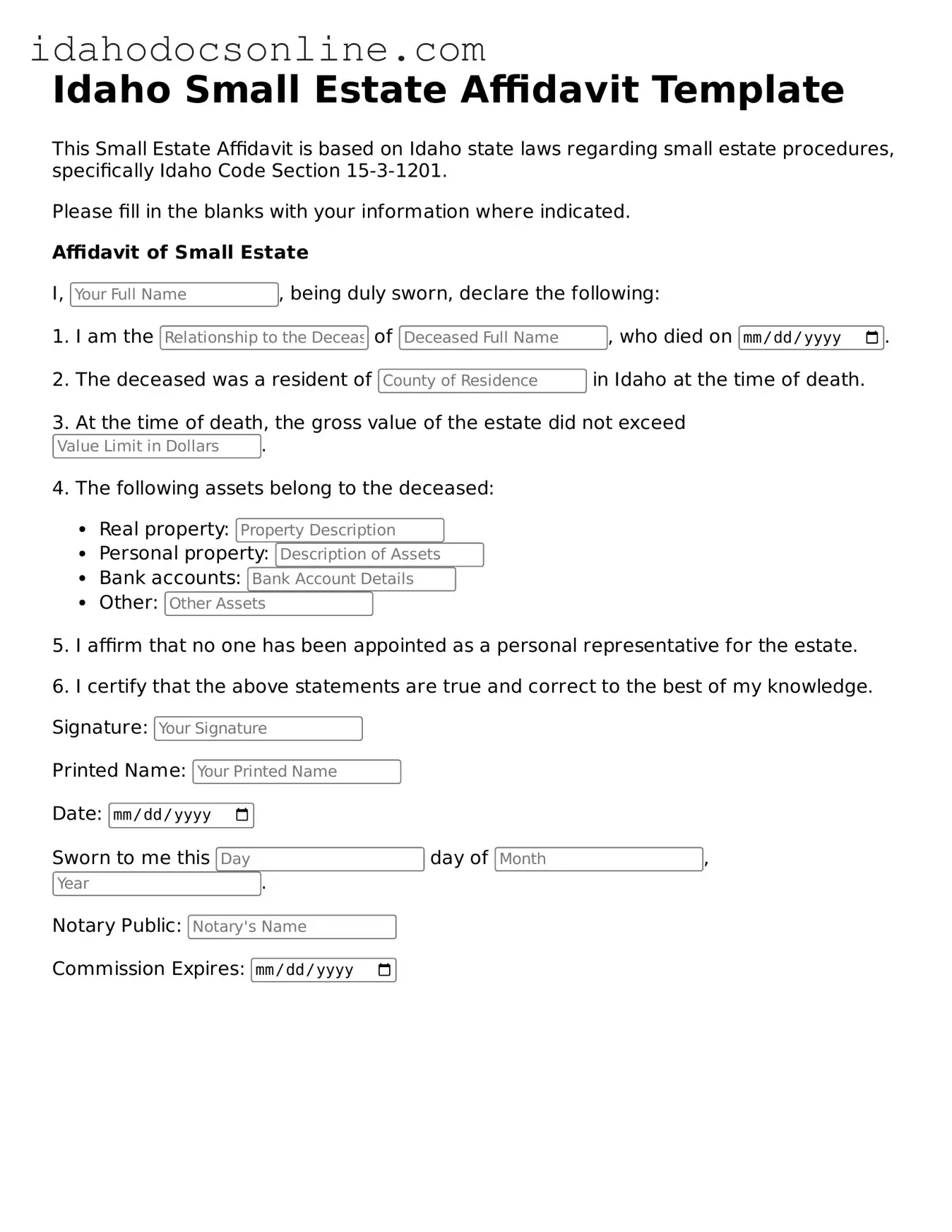

Free Small Estate Affidavit Form for Idaho

The Idaho Small Estate Affidavit is a legal document that simplifies the process of settling the estate of a deceased individual when the total value of the estate is below a certain threshold. This form allows heirs to claim assets without going through a lengthy probate process, making it a valuable tool for those navigating estate matters in Idaho. If you need to fill out this form, click the button below.

Fill Out Your Document

Free Small Estate Affidavit Form for Idaho

Fill Out Your Document

Need speed? Complete the form now

Complete Small Estate Affidavit online — edit, save, download with ease.

Fill Out Your Document

or

Free PDF