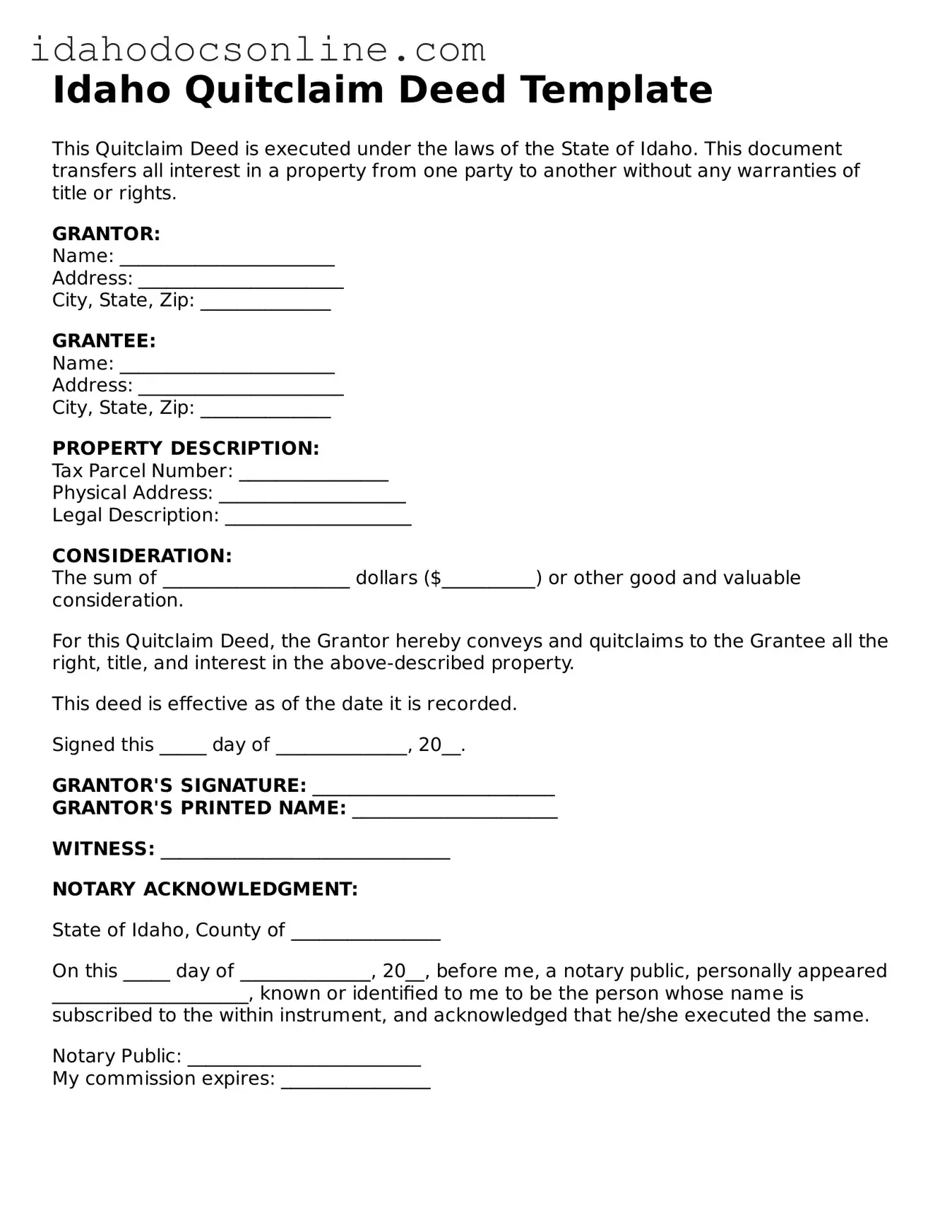

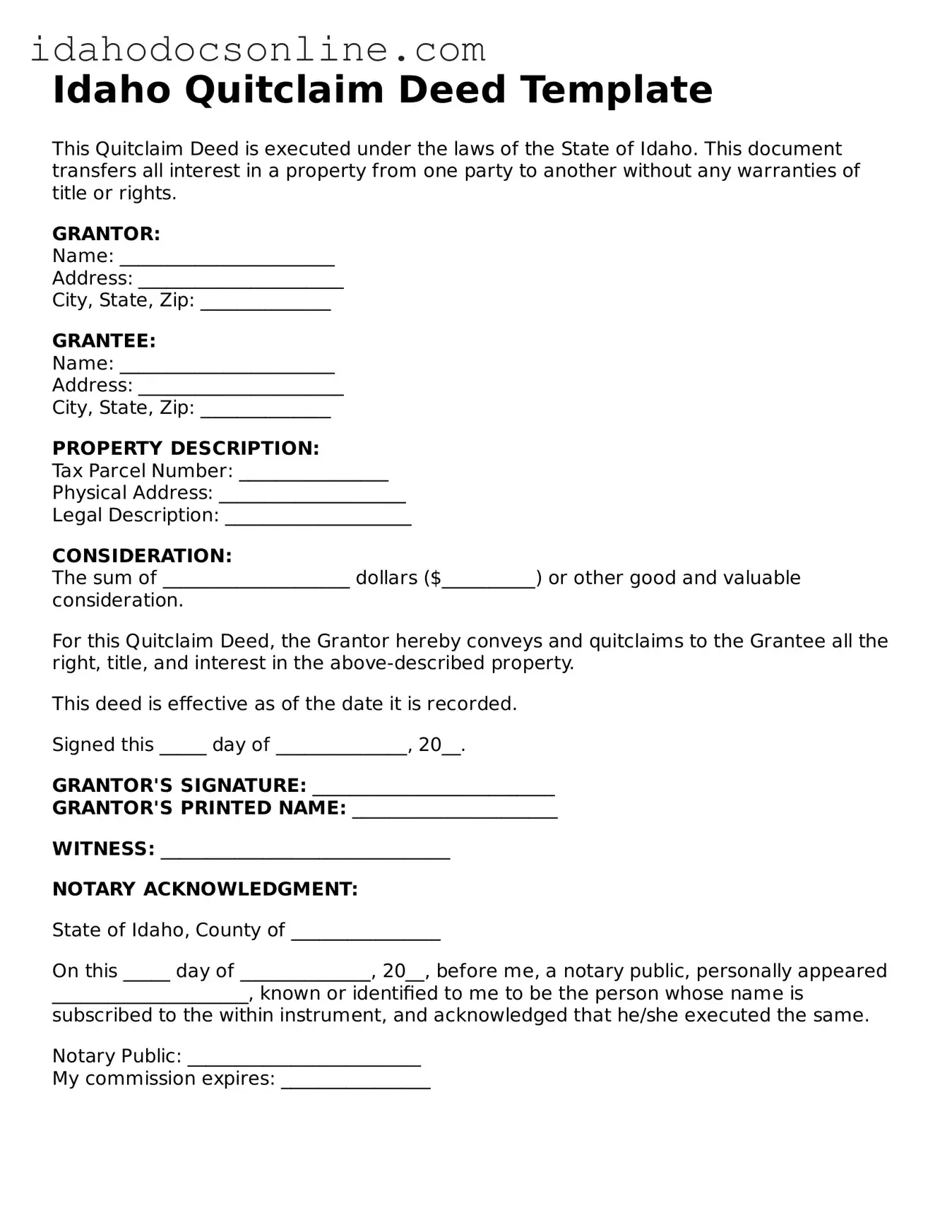

Free Quitclaim Deed Form for Idaho

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without guaranteeing the title's validity. This form is particularly useful in situations where the parties involved have a pre-existing relationship, such as family members or friends, as it allows for a straightforward transfer of property rights. If you're ready to fill out the Idaho Quitclaim Deed form, click the button below.

Fill Out Your Document

Free Quitclaim Deed Form for Idaho

Fill Out Your Document

Need speed? Complete the form now

Complete Quitclaim Deed online — edit, save, download with ease.

Fill Out Your Document

or

Free PDF