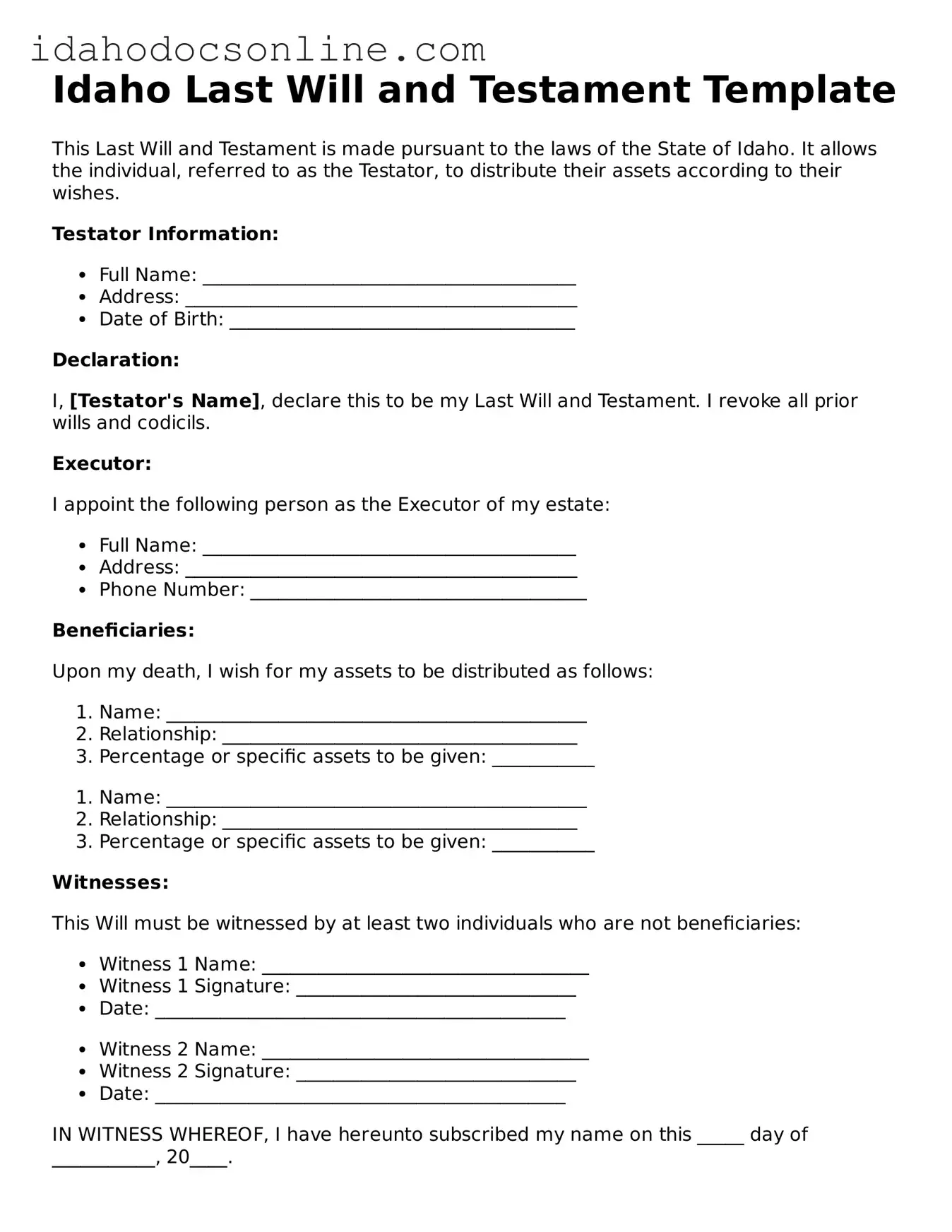

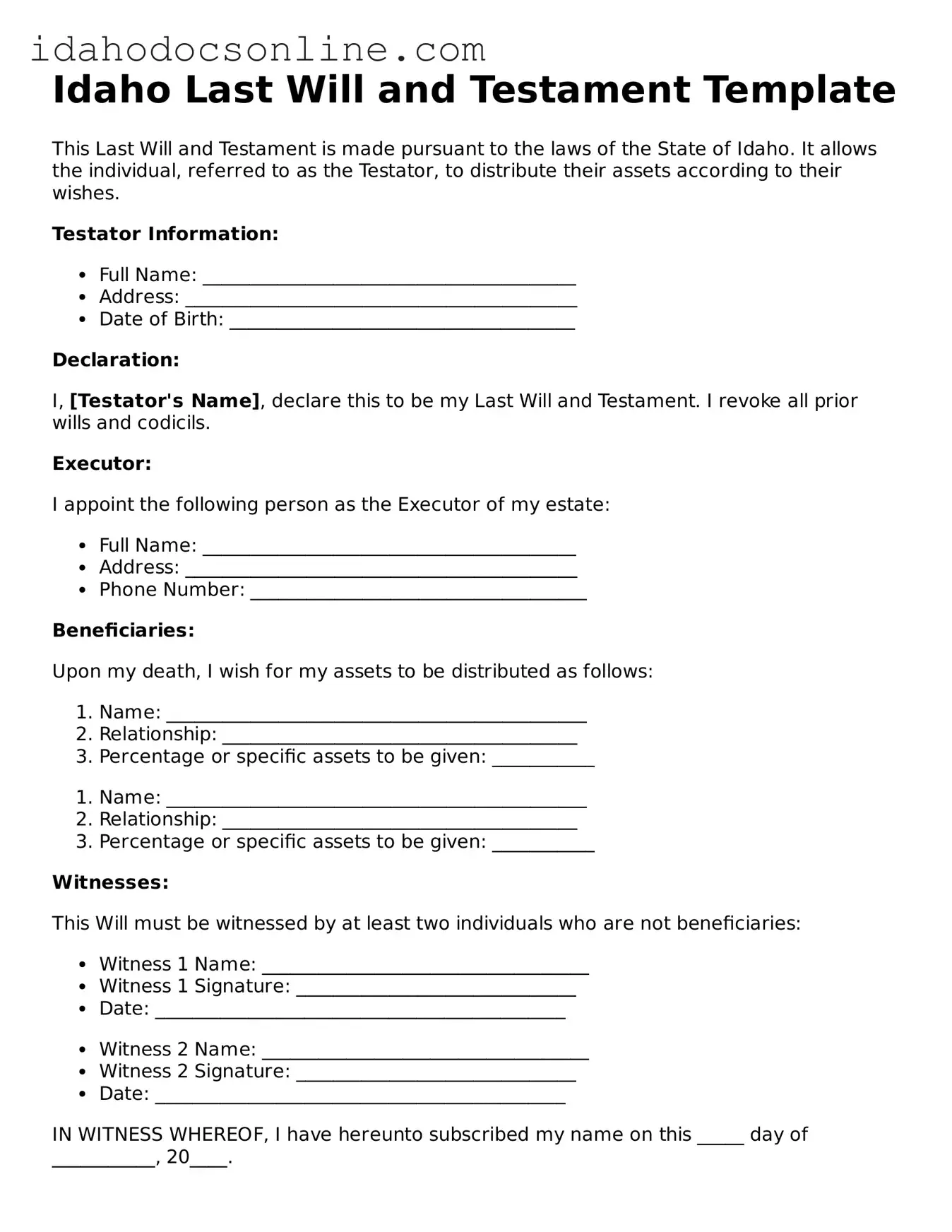

Free Last Will and Testament Form for Idaho

A Last Will and Testament form in Idaho is a legal document that outlines how a person's assets and affairs should be handled after their death. This essential form ensures that your wishes are respected and provides clarity to your loved ones during a difficult time. To get started on securing your legacy, fill out the form by clicking the button below.

Fill Out Your Document

Free Last Will and Testament Form for Idaho

Fill Out Your Document

Need speed? Complete the form now

Complete Last Will and Testament online — edit, save, download with ease.

Fill Out Your Document

or

Free PDF