|

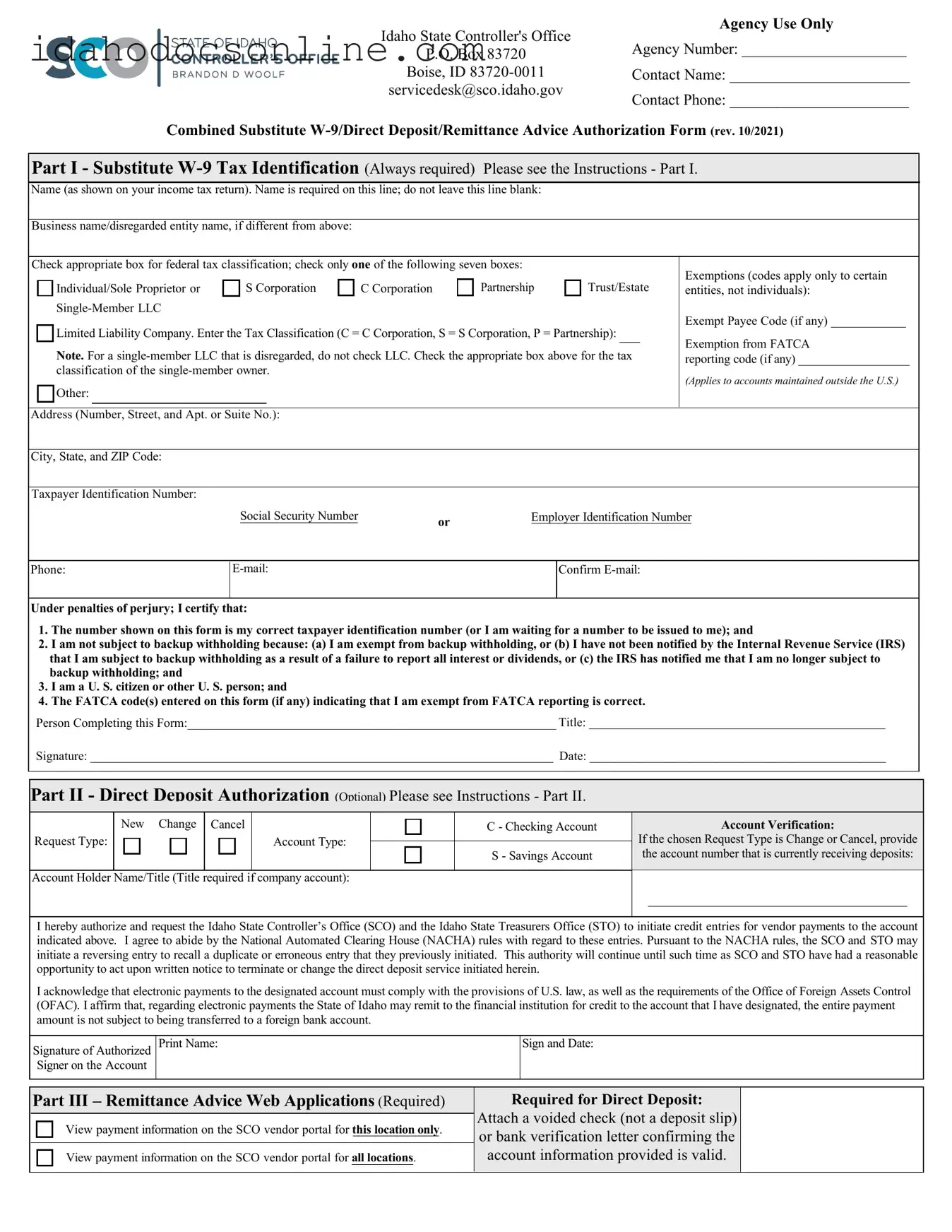

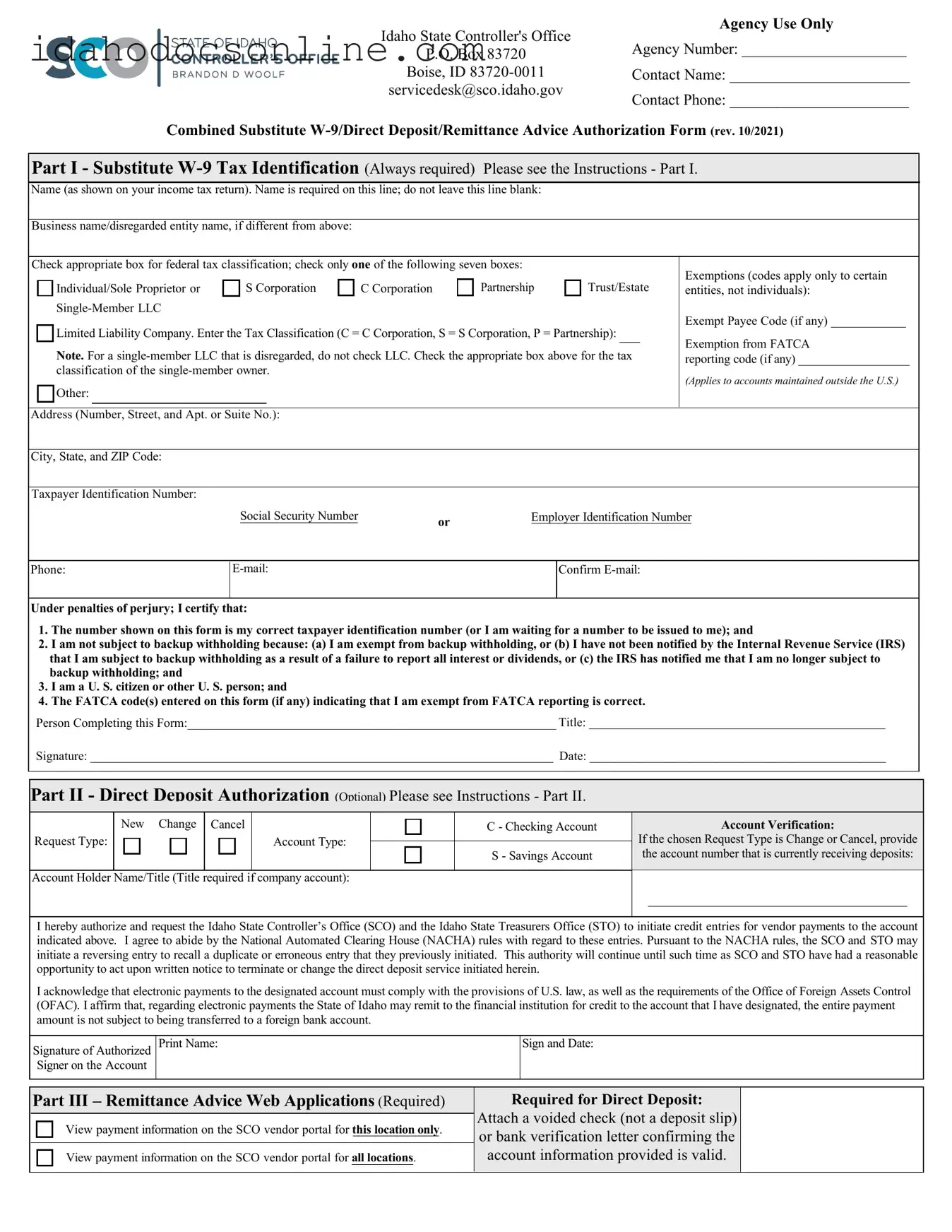

Idaho State Controller's Office |

Agency Use Only |

|

Agency Number: _____________________ |

|

P.O. Box 83720 |

|

Boise, ID 83720-0011 |

Contact Name: _______________________ |

|

servicedesk@sco.idaho.gov |

Contact Phone: _______________________ |

|

|

Combined Substitute W-9/Direct Deposit/Remittance Advice Authorization Form (rev. 10/2021)

Part I - Substitute W-9 Tax Identification (Always required) Please see the Instructions - Part I.

Name (as shown on your income tax return). Name is required on this line; do not leave this line blank:

Business name/disregarded entity name, if different from above:

Check appropriate box for federal tax classification; check only one of the following seven boxes: |

|

|

|

|

Exemptions (codes apply only to certain |

|

|

|

S |

|

P |

|

|

S Corporation |

|

C Corporation |

|

Partnership |

|

Trust/Estate |

|

|

|

|

|

|

|

|

|

entities, not individuals): |

|

|

Individual/ |

ole |

|

roprietor or |

|

|

|

|

|

|

|

|

|

|

Single-Member LLC |

|

|

|

|

|

|

|

|

|

|

|

Exempt Payee Code (if any) ____________ |

|

|

Limited Liability Company. Enter the Tax Classification (C = C Corporation, S = S Corporation, P = Partnership): |

|

|

|

|

Exemption from FATCA |

|

|

Note. For a single-member LLC that is disregarded, do not check LLC. Check the appropriate box above for the tax |

|

|

reporting code (if any) __________________ |

|

|

classification of the single-member owner. |

|

|

|

|

|

|

|

|

(Applies to accounts maintained outside the U.S.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (Number, Street, and Apt. or Suite No.):

City, State, and ZIP Code:

Taxpayer Identification Number:

Social Security Number |

or |

Employer Identification Number |

|

|

Under penalties of perjury; I certify that:

1.The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me); and

2.I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and

3.I am a U. S. citizen or other U. S. person; and

4.The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct.

Person Completing this Form:___________________________________________________________ Title: _______________________________________________

Signature: __________________________________________________________________________ Date: _______________________________________________

Part II - Direct Deposit Authorization (Optional) Please see Instructions - Part II.

New Change Cancel |

|

|

|

C - Checking Account |

Request Type: |

|

|

|

|

|

|

Account Type: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S - Savings Account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Holder Name/Title (Title required if company account):

Account Verification:

If the chosen Request Type is Change or Cancel, provide the account number that is currently receiving deposits:

I hereby authorize and request the Idaho State Controller’s Office (SCO) and the Idaho State Treasurers Office (STO) to initiate credit entries for vendor payments to the account indicated above. I agree to abide by the National Automated Clearing House (NACHA) rules with regard to these entries. Pursuant to the NACHA rules, the SCO and STO may initiate a reversing entry to recall a duplicate or erroneous entry that they previously initiated. This authority will continue until such time as SCO and STO have had a reasonable opportunity to act upon written notice to terminate or change the direct deposit service initiated herein.

I acknowledge that electronic payments to the designated account must comply with the provisions of U.S. law, as well as the requirements of the Office of Foreign Assets Control (OFAC). I affirm that, regarding electronic payments the State of Idaho may remit to the financial institution for credit to the account that I have designated, the entire payment amount is not subject to being transferred to a foreign bank account.

Signature of Authorized Signer on the Account

Part III – Remittance Advice Web Applications (Required)

View payment information on the SCO vendor portal for this location only.

View payment information on the SCO vendor portal for all locations.

Required for Direct Deposit:

Attach a voided check (not a deposit slip) or bank verification letter confirming the account information provided is valid.

Instructions - Part I

SCO will only accept the most current version of the Combined Substitute W-9 located on the SCO Web site.

The State of Idaho is about to pay you an amount that may be reported to the Internal Revenue Service (IRS). The State of Idaho will comply with all applicable Federal and State of Idaho reporting requirements. If the amount is reportable to the IRS, they will match this amount to your tax return. In order to avoid additional IRS scrutiny, we must provide the IRS with your name and Social Security Number or Employer Identification Number. The name we need is the name that you use on your tax returns related to this payment. We are required by law to obtain this information.

For instructions to complete Part 1, please review the full IRS Form W-9 Instructions found on the IRS website at www.irs.gov.

U. S. Person: This form may be used only by a U. S. person, including a resident alien. Foreign persons should furnish us with the appropriate Form W-8. For a complete IRS definition of U. S. Person, consult the IRS website at www.irs.gov.

Penalties: Failure to provide a correct name and Taxpayer Identification Number will delay the issuance of your payment and may subject you to a $50 penalty imposed by the IRS under section 6723. If you make a false statement with no reasonable basis that results in no backup withholding, you could be subject to a $500 civil penalty. Willfully falsifying certifications or affirmations may subject you to criminal penalties including fines and/or imprisonment.

Confidentiality: If we disclose or use your Taxpayer Identification Number in violation of Federal law, we may be subject to civil and criminal penalties.

Privacy Act Notice: You must provide your TIN whether or not you are required to file a tax return. If you do not provide your TIN, certain penalties may apply. Section 6109 of the Internal Revenue Code requires you to provide your correct TIN to persons who must file information returns with the IRS to report interest, dividends and certain other income paid to you, mortgage interest you paid, the acquisition or abandonment of secured property, cancellation of debt, or contributions you made to an IRA or Archer MSA. The IRS uses the number for identification purposes and to help verify the accuracy of your tax return. The IRS may also provide this information to the Department of Justice for civil and criminal litigation, and to cities, states and the District of Columbia to carry out their tax laws. We may also disclose this information to other countries under a tax treaty, or to Federal and state agencies to enforce Federal non-tax criminal laws and to combat terrorism.

Instructions - Part II

Complete this section if you wish to receive payments by direct deposit. If you elect to receive payments by direct deposit, you will be provided access to SCO Vendor Remittance applications on the SCO website and paper remittance advice payment information will no longer be issued.

Submit your direct deposit request via one of the following methods:

•Online Form - Fill out and submit this form with an attached scan of a voided check (not a deposit slip) or bank verification letter of your checking or saving account number. Form location: https://www.sco.idaho.gov/LivePages/STARS-Forms.aspx

•E-mail - Attach the form along with a scan of a voided check (not a deposit slip) or bank verification letter of your checking or savings account number to an email addressed to servicedesk@sco.idaho.gov.

•Mail - Fill out the form and send it along with a voided check (not a deposit slip) or a bank verification letter of your checking or savings account number to the following address:

Idaho State Controller's Office

P.O. Box 83720

Boise, ID 83720-0011

-To reduce the risk of fraud, the SCO may contact you to verify the banking information you provide-

Invalid account information will be rejected, generating a notice of change. A notice of change will void this request form. Payments will continue to be sent via mailed paper warrant until a direct deposit request is processed successfully.

If you are changing or canceling your direct deposit, please provide the account number that is currently receiving deposits in this request.

Instructions – Part III

The Idaho State Controller’s Office provides vendors the ability to view payment information through Vendor Remittance applications accessed via the SCO website, www.sco.idaho.gov. For more information, refer to the Vendor Remittance FAQ page available on the SCO website.

Access to Vendor Remittance Applications for Vendors that receive payments via Direct Deposit: All vendors that receive payments via direct deposit are provided access to Vendor Remittance with viewing access to payment information for one or all address locations associated with the Taxpayer Identification Number provided in Part I. Initial sign in instructions will be sent to your email address provided in Part I.

Access to Vendor Remittance Applications Without Receiving Payments by Direct Deposit: Complete Part I and Part III of the form, choosing whether to view payment information for one or all address locations associated with the Taxpayer Identification Number

provided in Part I. Initial sign in instructions are sent to the email address provided in Part I.