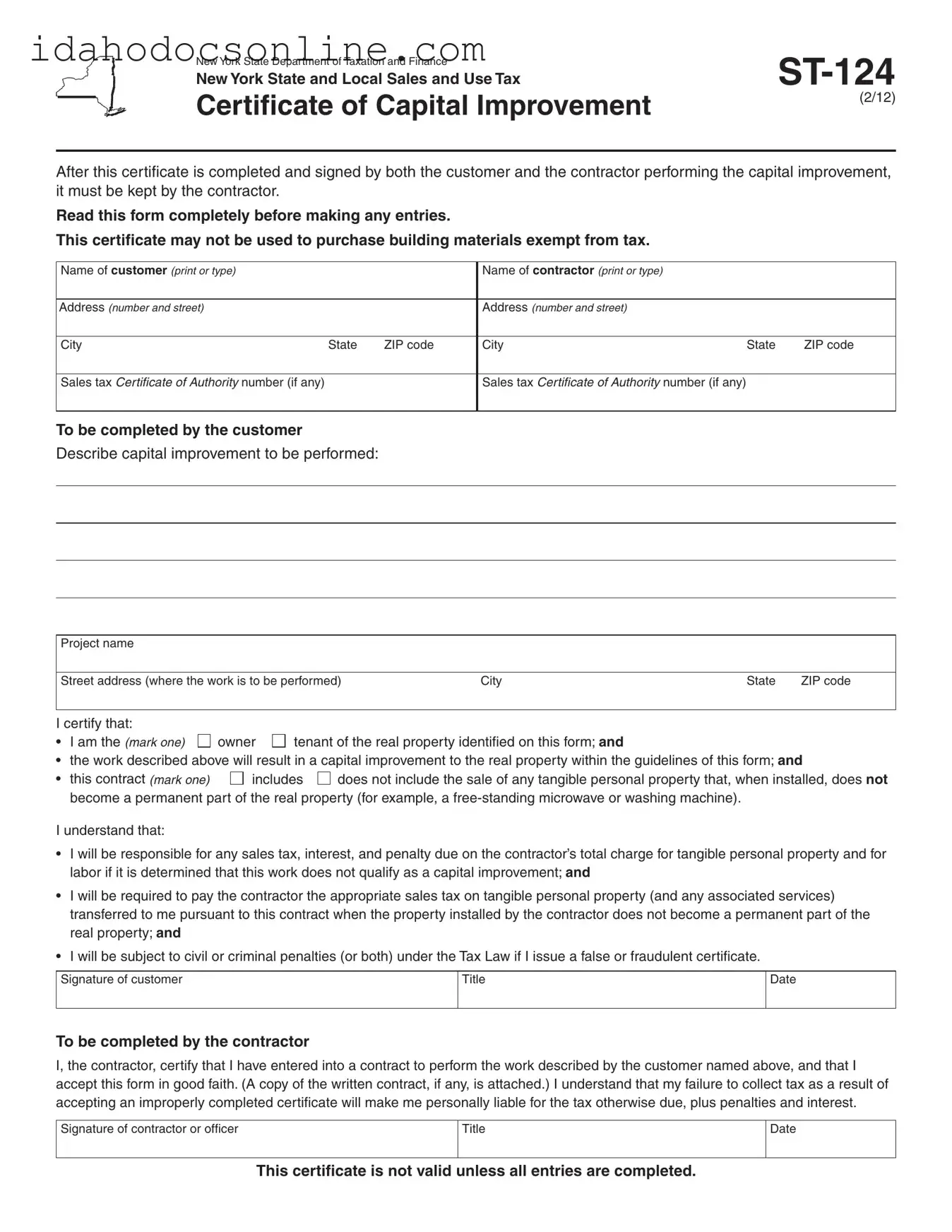

When the customer completes this certificate and gives it to the contractor, who accepts it in good faith, it is evidence that the work to be performed will result in a capital improvement to real property.

A capital improvement to real property is an addition or alteration to real property that:

(a)substantially adds to the value of the real property or appreciably prolongs the useful life of the real property, and

(b)becomes part of the real property or is permanently affixed to the real property so that removal would cause material damage to the property or article itself, and

(c)is intended to become a permanent installation.

The work performed by the contractor must meet all three of these requirements to be considered a capital improvement. This certificate may not be issued unless the work qualifies as a capital improvement.

If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of building materials or other tangible personal property, but is not required to collect tax from the customer for the capital improvement.

For guidance as to whether a job is a repair or a capital improvement, see Publication 862, Sales and Use Tax Classifications of Capital Improvements and Repairs to Real Property.

A contractor, subcontractor, property owner, or tenant, may not use this certificate to purchase building materials or other

tangible personal property tax free.

of this certificate does not relieve the contractor of the liability for sales tax on the purchase of building materials or other tangible personal property subsequently incorporated into the real property as a capital improvement unless the contractor can legally issue Form ST-120.1, Contractor Exempt Purchase Certificate. (See Publication 862 for additional information.)

The term materials is defined as items that become a physical component part of real or personal property, such as lumber, bricks, or steel. This term also includes items such as doors, windows, sinks, and furnaces used in construction.

Floor covering

Floor covering such as carpet, carpet padding, linoleum and vinyl roll flooring, carpet tile, linoleum tile, and vinyl tile installed as the initial finished floor covering in new construction, a new addition to an existing building or structure, or in a total reconstruction of an existing building or structure, constitutes a capital improvement regardless of the method of installation. As a capital improvement, the charge to the property owner for the installation of floor covering is not subject to New York State and local sales and use taxes. However, the retail purchase of floor covering (such as carpet or padding) itself is subject to tax.

Floor covering installed other than as described above does not qualify as a capital improvement. Therefore, the charges for materials and labor are subject to sales tax. The contractor may apply for a credit or refund of any sales tax already paid on the materials.

The term floor covering does not include flooring such as ceramic tile, hardwood, slate, terrazzo, and marble. The rules

for determining when floor covering constitutes a capital improvement do not apply to such flooring. The criteria stated in (a), (b), and (c) above apply to such flooring.

A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, and reasonable ordinary due care is exercised in the acceptance of the certificate.

If a contractor gets a properly completed Form ST-124 from the customer within 90 days after rendering services, and accepts it in good faith, the customer bears the burden of proving the job or transaction was not taxable.

If you are a contractor who installs items such as washing machines, clothes dryers, dishwashers, refrigerators, furniture, etc., which when installed or placed in real property do not become part of the real property, you must collect tax on your charge for the installation. The individual charge for any of these items is also taxable as the sale of tangible personal property.

If a contractor does not get a properly completed Certificate of Capital Improvement within 90 days, the contractor bears the burden of proving the work or transaction was a capital improvement. The failure to get a properly completed certificate, however, does not change the taxable status of a transaction; a contractor may still show that the transaction was a capital improvement.

The contractor must keep any exemption certificate for at least three years after the due date of the last return to which it relates, or the date the return was filed, if later. The contractor must also maintain a method of associating an exempt sale made to a particular customer with the exemption certificate on file for that customer.

Need help?

Visit our Web site at www.tax.ny.gov

•get information and manage your taxes online

•check for new online services and features

Telephone assistance |

|

Sales Tax Information Center: |

(518) 485-2889 |

To order forms and publications: |

(518) 457-5431 |

Text Telephone (TTY) Hotline (for persons with

hearing and speech disabilities using a TTY): (518) 485-5082

Persons with disabilities: In compliance with the Americans with Disabilities Act, we will ensure that our lobbies, offices, meeting rooms, and other facilities are

accessible to persons with disabilities. If you have questions about special accommodations for persons with disabilities, call the information center.

Privacy notification

The Commissioner of Taxation and Finance may collect and maintain personal information pursuant to the New York State Tax Law, including but not limited to, sections 5-a, 171, 171-a, 287, 308, 429, 475, 505, 697, 1096, 1142, and 1415 of that Law; and may require disclosure of social security numbers pursuant to 42 USC 405(c)(2)(C)(i).

This information will be used to determine and administer tax liabilities and, when authorized by law, for certain tax offset and exchange of tax information programs as well as for any other lawful purpose.

Information concerning quarterly wages paid to employees is provided to certain state agencies for purposes of fraud prevention, support enforcement, evaluation of the effectiveness of certain employment and training programs and other purposes authorized by law.

Failure to provide the required information may subject you to civil or criminal penalties, or both, under the Tax Law.

This information is maintained by the Manager of Document Management, NYS Tax Department, W A Harriman Campus, Albany NY 12227; telephone (518) 457-5181.