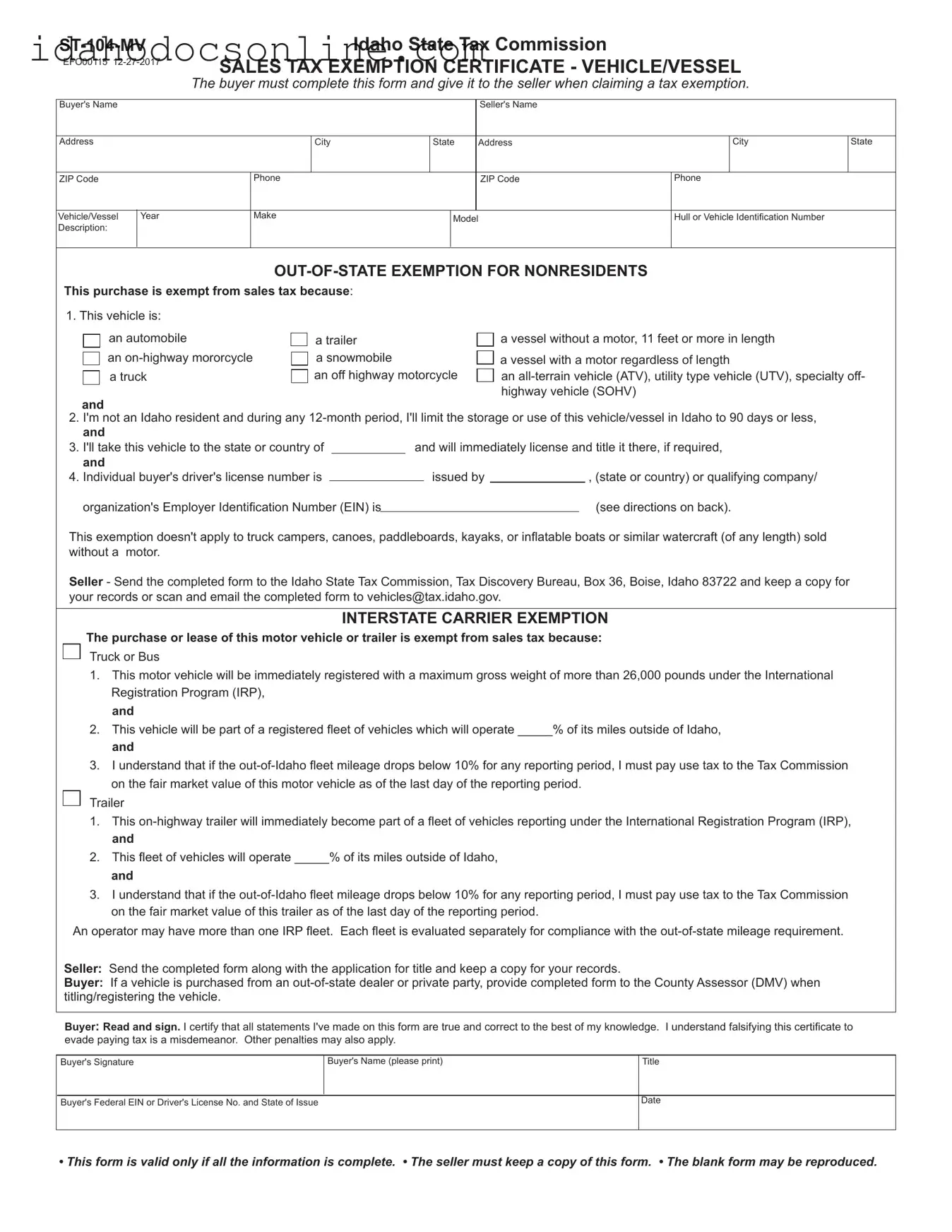

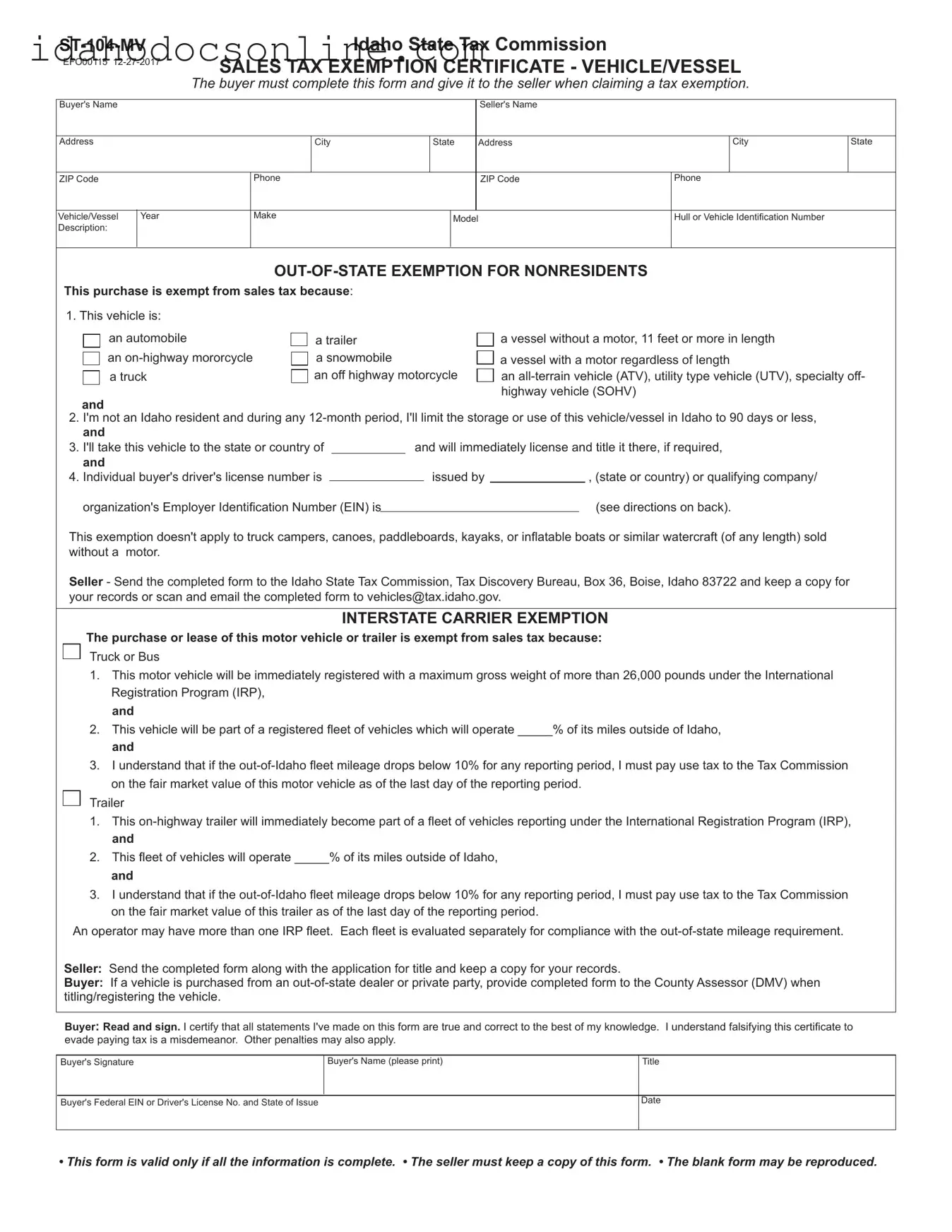

Instructions for Form ST-104-MV

(Idaho Code Section 63-3622R and Sales Tax Rule 101 & 107)

OUT-OF-STATE EXEMPTION FOR NONRESIDENTS

When a vehicle or vessel is bought by a nonresident for use outside Idaho, it may qualify for an exemption from Idaho sales tax. Truck campers, canoes, paddleboards, kayaks, infl atable boats, or similar watercraft (of any length) sold without a motor don't qualify for this exemption.

To claim an exemption the buyer must complete a Form ST-104-MV (Sales Tax Exemption Certifi cate - Vehicle/Vessel) stating that the vehicle or vessel:

•Will immediately be taken out of Idaho and titled and registered in another state or country (if required), and

•Won't be stored or used in Idaho for more than 90 days in any 12-month period.

Idaho residents can't claim this exemption.

A company/organization qualifi es for this exemption only if it meets all three of the following criteria:

•It's a corporation, partnership, limited liability company, or other organization that isn't formed under the laws of Idaho,

and

•It's not required to be registered with the Idaho Secretary of State to do business in Idaho,

and

•It doesn't have signifi cant contacts and consistent operations in Idaho.

INTERSTATE CARRIER EXEMPTION

Sales of motor vehicles for use in interstate commerce are exempt if:

•The vehicle will be immediately registered with a maximum gross registered weight of more than 26,000 pounds under the International Registration Plan,

and

•At least 10% of the purchaser's total fl eet mileage is outside of Idaho.

The buyer must complete Form ST-104-MV and acknowledge that, if the fl eet mileage drops below the 10% out-of-state requirement in any subsequent reporting periods, the vehicles will be subject to use tax at that time.

The exemption applies only to purchases of trucks, buses, and trailers, but not their repair or maintenance. However, the sale of a "glider kit" isn't taxable when used to assemble a glider kit vehicle that will be registered in an IRP fl eet and will meet the weight and mileage requirements listed above.

Rule 128 states that if you don't receive an exemption certifi cate from the buyer at the time of sale, the sale is presumed to be taxable. If you receive an exemption certifi cate after the sale, but don't get it within a reasonable length of time, the Tax Commission will review the certifi cate with all other avail- able evidence to determine whether you have clearly proven that the sale was exempt from tax.