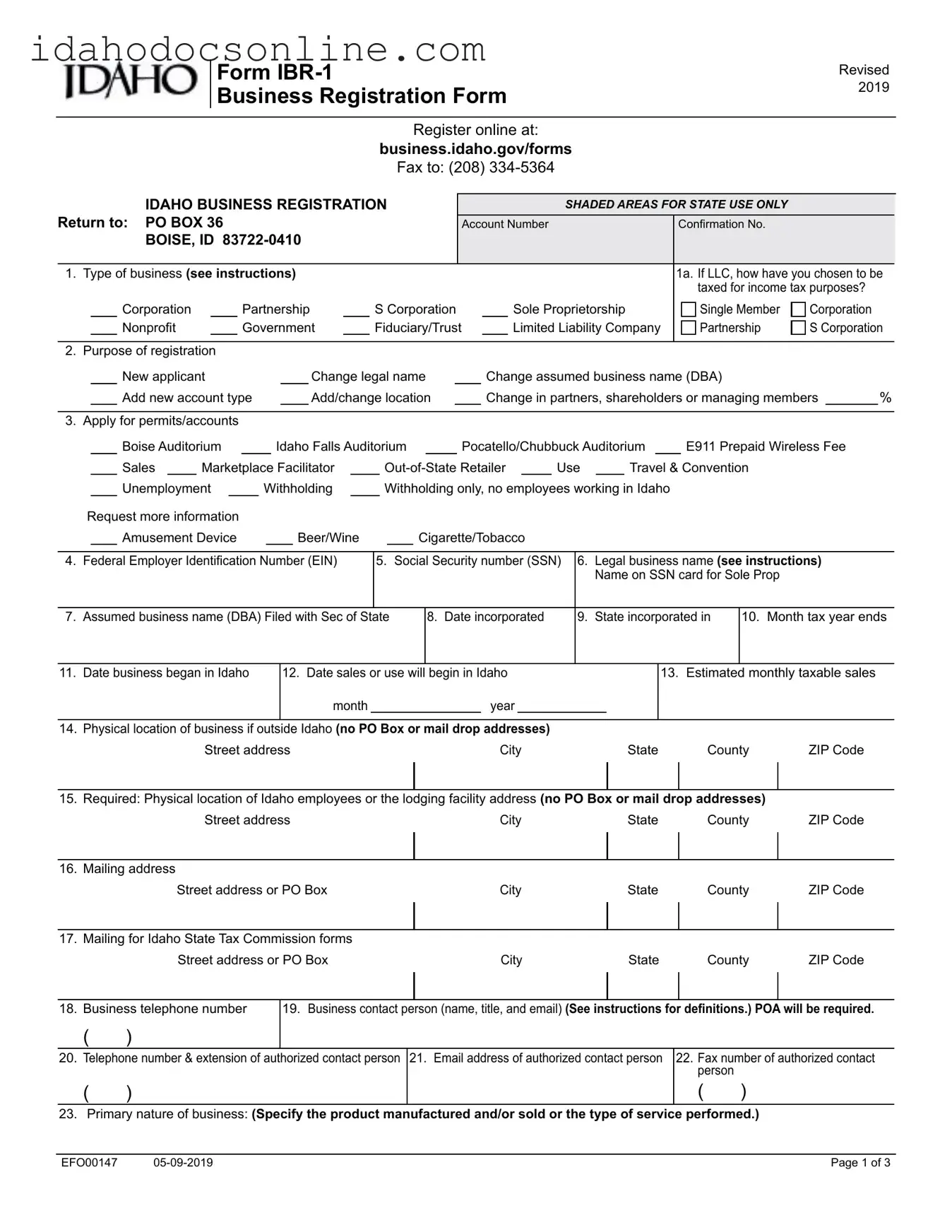

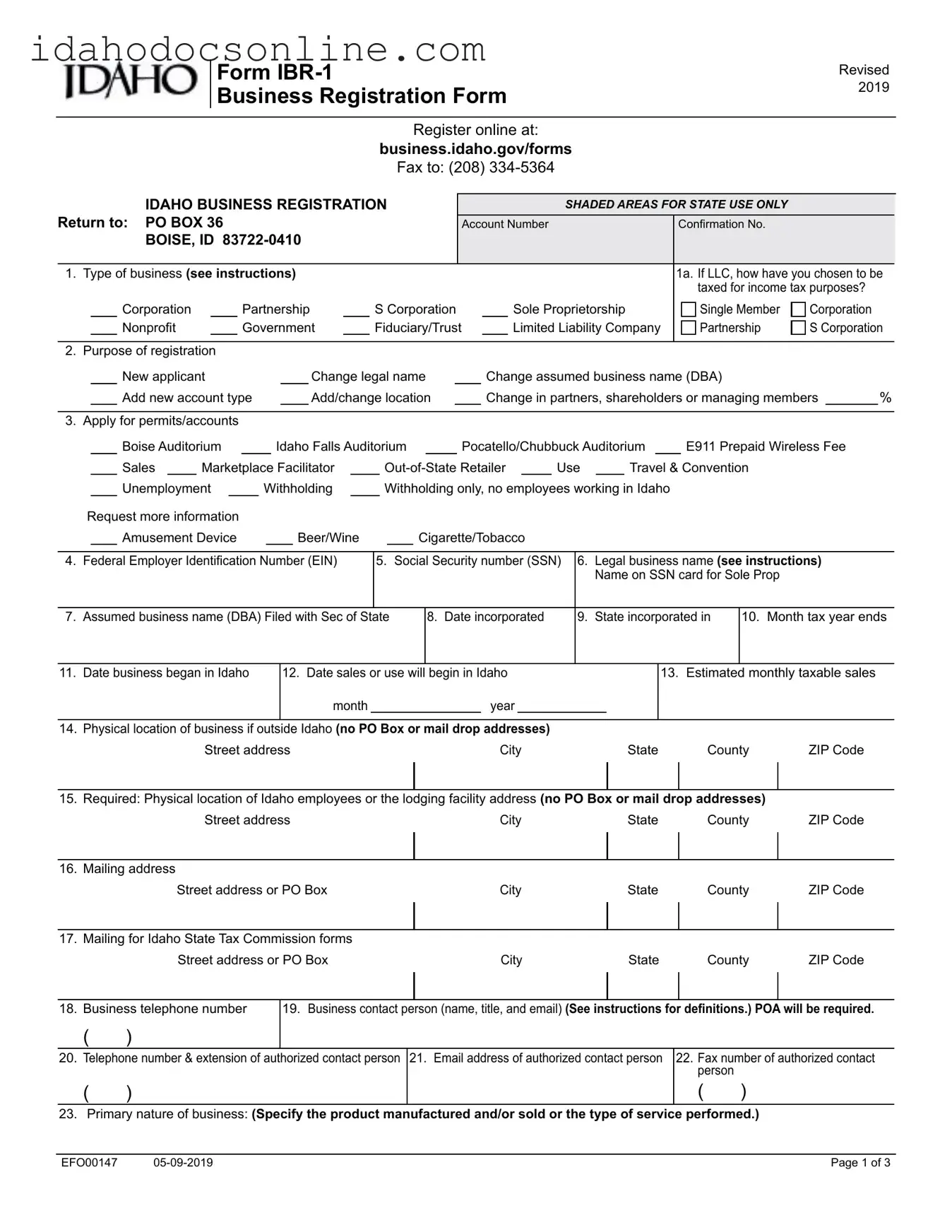

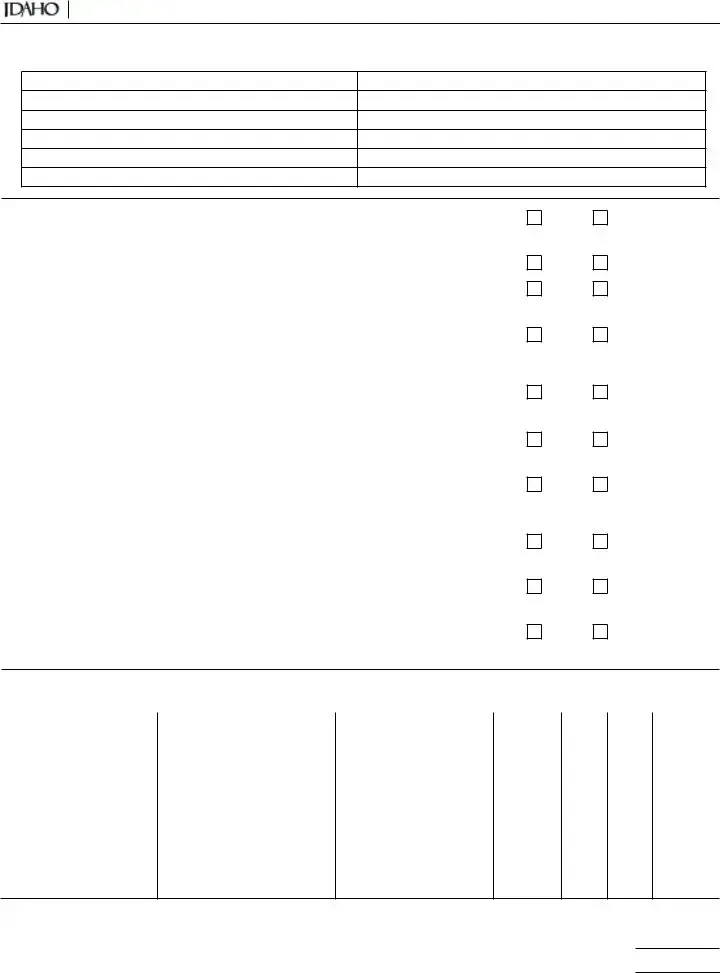

4.List your federal Employer Identification Number

(EIN) if one has been issued to you by the Internal Revenue Service. If you have employees, or the business is other than a sole proprietorship, you must have a federal EIN. If you have applied

for your EIN, but have not received it yet, enter “applied for.” If you are not required to have an EIN, leave this box blank.

5.Enter your Social Security number if the type of business entity is a sole proprietorship.

6.List the legal name of the business. If the business is owned by a sole proprietor, list the name shown on the owner’s Social Security card.

If the business is owned by a corporation, limited liability company or partnership, list the legal name as registered with the Secretary of State.

7.List the assumed business name (DBA), if different than the legal business name. (Example: Legal name Karan Jones - DBA Karan’s Flowers.) This name must also be registered with the Secretary of State, (208) 334-2301.

8.If your business is a corporation, enter the date incorporated.

9.If your business is a corporation, enter the state in which it was incorporated.

10.If the business files income tax returns on a calendar year basis, enter December. If the business files income tax returns on a fiscal year basis, enter the month the business’ fiscal year ends.

11.Enter the date this business began operating in Idaho.

13.Estimate the highest amount of taxable sales the business will have in any month.

14.List the business’ physical location in Idaho. If you have more than one location, include a separate page listing the additional locations.

(Don’t use a PO Box or mail drop address.)

15.List the physical location where employees will perform work or the lodging facility where the accommodations are located.

17.If you wish to have the Idaho State Tax Commission report forms mailed to an address different than the one listed on line 15 (such as your accountant’s address), list that address.

18-22. You are authorizing the agencies with which you register to contact the named individual to discuss issues relating to your accounts. In some cases, there may be additional Power of Attorney requirements.

23.Describe in detail the products and/or services your business in Idaho will provide. (Example: Retail sales: clothing, food. Agricultural crops: corn, beets. General Contractor: building single- family homes.)

24.If this business entity or its owner, partners or members has ever had a withholding, sales, use, workers’ compensation or unemployment insurance number in Idaho, list all permits, accounts, or policy numbers.

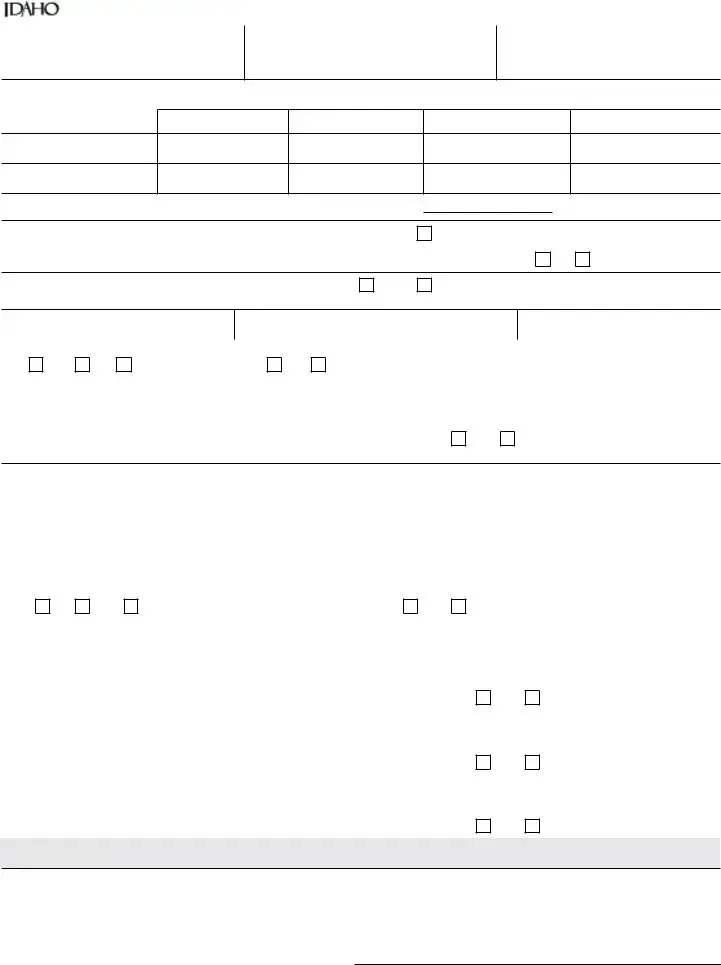

35.List the appropriate information:

If you marked government on number 1, line 24 is optional.

(a)If you marked Sole Proprietorship on number 1, list the requested information for the owner and spouse.

(b)If you marked Partnership on number 1, list the requested information for each partner. If the partner is an individual, list the Social Security number. If the partner is another business entity, list the EIN. If there are more than three partners, include an additional page listing them.

(c)If you marked S Corporation, Corporation, or Nonprofit on line 1, list the requested information for each officer. Indicate if the officer is on the board of directors by writing

“yes,” “no,” or “not applicable” (NA). If there are more than three officers, include an additional page listing them.

(d)If you marked Fiduciary/Trust, list the trustees or responsible parties. If there are more than three trustees or responsible parties, include an additional page listing them.

(e)If you marked Limited Liability Company on number 1, list the requested information for all members. If there are more than three members, include an additional page listing them.

41.The Internal Revenue Service grants or denies 501(c)(3) status. The granting of this status doesn’t exempt a business from unemployment insurance tax, sales tax, withholding or workers’ compensation insurance.

42.The Idaho Department of Labor offers businesses granted 501(c)(3) status three methods for paying state unemployment insurance tax liabilities.