OR850-U |

Idaho Self-Assessed Use Tax |

F |

|

M EFO00143 |

Worksheet and Return |

|

01-02-09 |

|

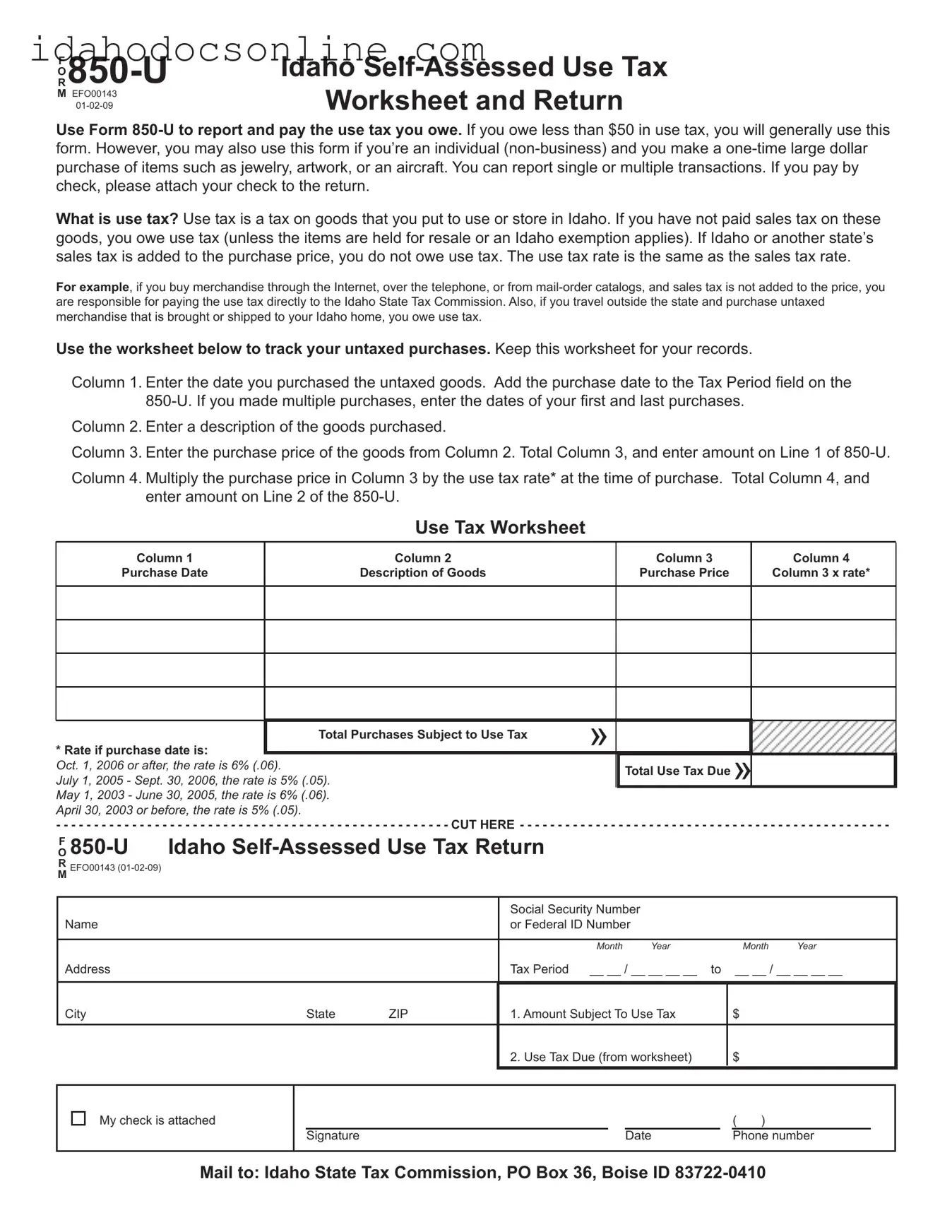

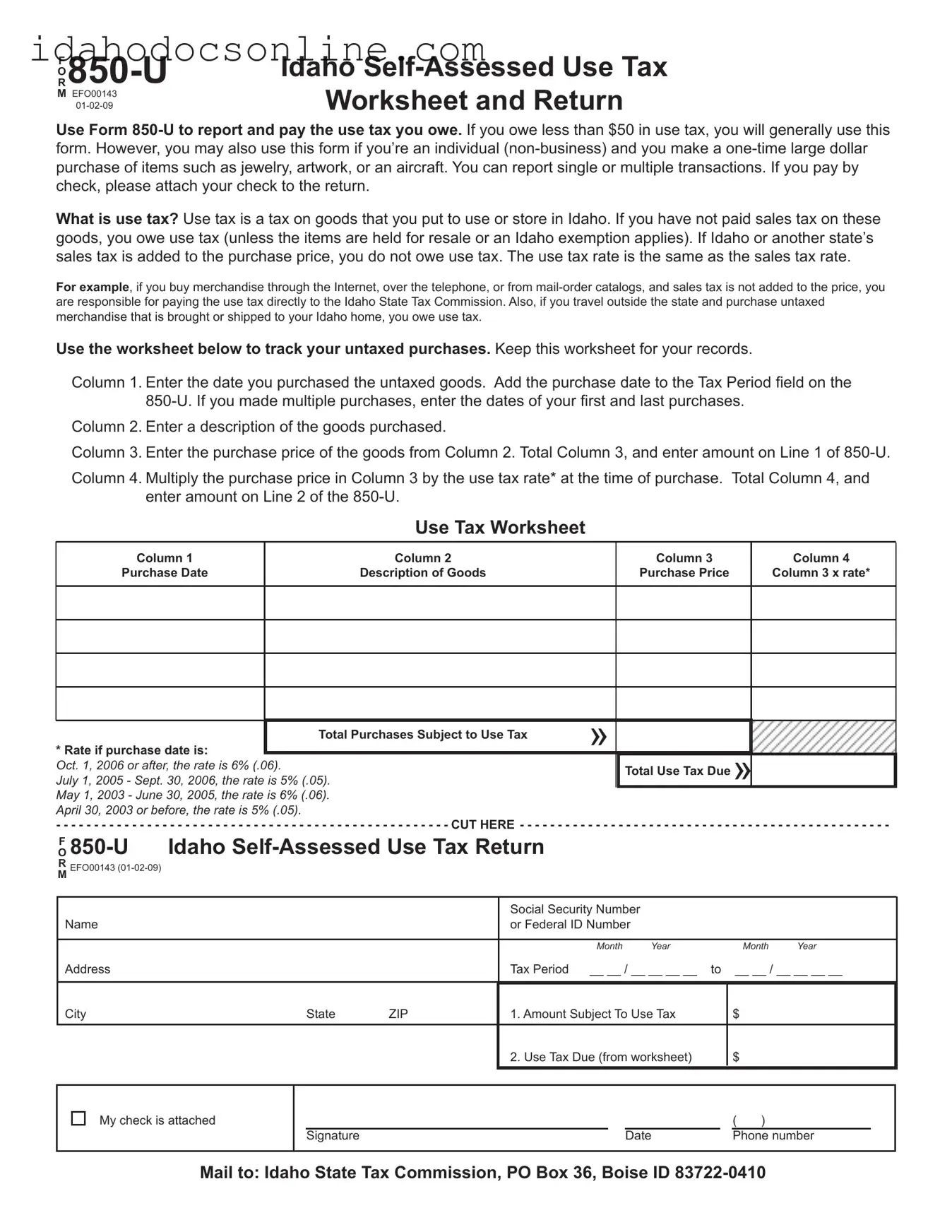

Use Form 850-U to report and pay the use tax you owe. If you owe less than $50 in use tax, you will generally use this form. However, you may also use this form if you’re an individual (non-business) and you make a one-time large dollar purchase of items such as jewelry, artwork, or an aircraft. You can report single or multiple transactions. If you pay by check, please attach your check to the return.

What is use tax? Use tax is a tax on goods that you put to use or store in Idaho. If you have not paid sales tax on these goods, you owe use tax (unless the items are held for resale or an Idaho exemption applies). If Idaho or another state’s sales tax is added to the purchase price, you do not owe use tax. The use tax rate is the same as the sales tax rate.

For example, if you buy merchandise through the Internet, over the telephone, or from mail-order catalogs, and sales tax is not added to the price, you are responsible for paying the use tax directly to the Idaho State Tax Commission. Also, if you travel outside the state and purchase untaxed merchandise that is brought or shipped to your Idaho home, you owe use tax.

Use the worksheet below to track your untaxed purchases. Keep this worksheet for your records.

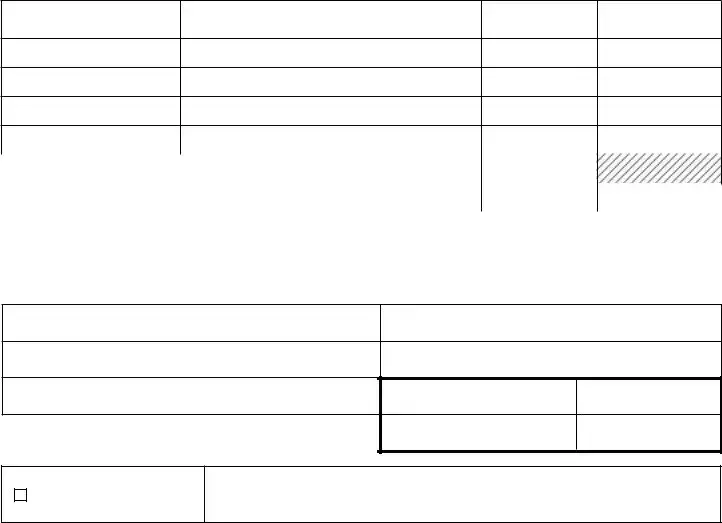

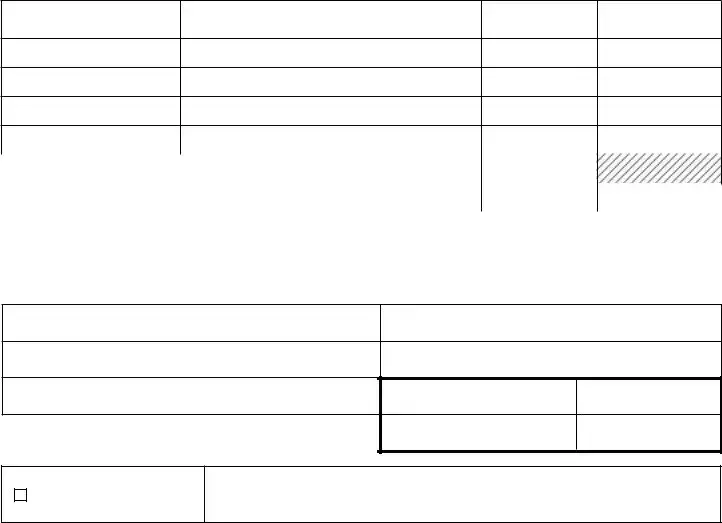

Column 1. Enter the date you purchased the untaxed goods. Add the purchase date to the Tax Period ield on the 850-U. If you made multiple purchases, enter the dates of your irst and last purchases.

Column 2. Enter a description of the goods purchased.

Column 3. Enter the purchase price of the goods from Column 2. Total Column 3, and enter amount on Line 1 of 850-U.

Column 4. Multiply the purchase price in Column 3 by the use tax rate* at the time of purchase. Total Column 4, and enter amount on Line 2 of the 850-U.

Use Tax Worksheet

Column 1 |

Column 2 |

Column 3 |

Column 4 |

Purchase Date |

Description of Goods |

Purchase Price |

Column 3 x rate* |

|

|

Total Purchases Subject to Use Tax |

» |

|

|

|

* Rate if purchase date is: |

|

|

|

|

|

|

|

|

|

Oct. 1, 2006 or after, the rate is 6% (.06). |

|

|

Total Use Tax Due » |

July 1, 2005 - Sept. 30, 2006, the rate is 5% (.05). |

|

|

May 1, 2003 - June 30, 2005, the rate is 6% (.06). |

|

|

|

|

April 30, 2003 or before, the rate is 5% (.05). |

|

|

|

|

- - - - - - - - - - - - - - - |

- - - - - - - - - - - - - |

- - - - - - - - - - - - - - - - - - - - - - - - CUT heRe - - - - - - - - - |

- - - - |

|

- - - - - - - - - - - - - - - - - - |

- - - - - - - - - - - - - - - - - - |

OF 850-U |

Idaho Self-Assessed Use Tax Return |

|

|

|

|

R EFO00143 (01-02-09) |

|

|

|

|

|

|

M |

|

|

|

|

|

|

Social Security Number or Federal ID Number

|

Month |

Year |

Month |

Year |

Tax Period |

__ __ / __ __ __ __ |

to __ __ / __ __ __ __ |

1. Amount Subject To Use Tax

2. Use Tax Due (from worksheet)

|

|

|

|

|

|

|

|

|

( |

) |

Signature |

|

Date |

|

Phone number |

Mail to: Idaho State Tax Commission, PO Box 36, Boise ID 83722-0410