aircraft, you are entitled to a refund of the difference between the diesel fuel tax rate and the jet fuel tax rate.

Complete Section V FUELS TAX REFUND to compute

the refund amount for the gasoline and/or diesel fuel tax

and Section VI FUELS TAX DUE to compute the aviation

gasoline and/or jet fuel tax due.

AIRCRAFT FUELS TAX DUE

Complete Section VI FUELS TAX DUE of this form to compute the aircraft fuels tax due if the Idaho fuels tax has not been paid on the diesel, gasoline, or other fuels used in your aircraft. You must report the tax due at the jet fuel or aviation gasoline tax rate.

USE TAX DUE

Use tax does not apply when the fuel purchased would qualify for the production, manufacturing,

farming, or other exemptions.

When fuel is not subject to motor fuels tax, it is subject to sales tax unless a sales tax exemption applies. If sales tax was not collected on its purchase, the purchaser owes use tax.

Use tax is a tax on goods that are put to use in Idaho. If sales tax has not been paid on goods that are used (or stored for later use), the person who uses or stores the goods in Idaho owes a use tax (unless the goods are held for resale or some other exemption applies).

The sale of motor fuel is exempt from sales and use tax if the fuel is subject to motor fuel tax or if the motor fuel tax is paid when the fuel is purchased. However, when a refund of the motor fuel tax is obtained, the value of the fuel less the state and federal taxes, if applicable, becomes subject to use tax. (See Speciic Line 4

Instructions for Section VII to determine if federal taxes are deductible.)

If you owe use tax, you must report it on your Idaho income tax return, Idaho sales or use tax return, or Form 75 by completing Section VII USE TAX DUE.

DETAILED INSTRUCTIONS

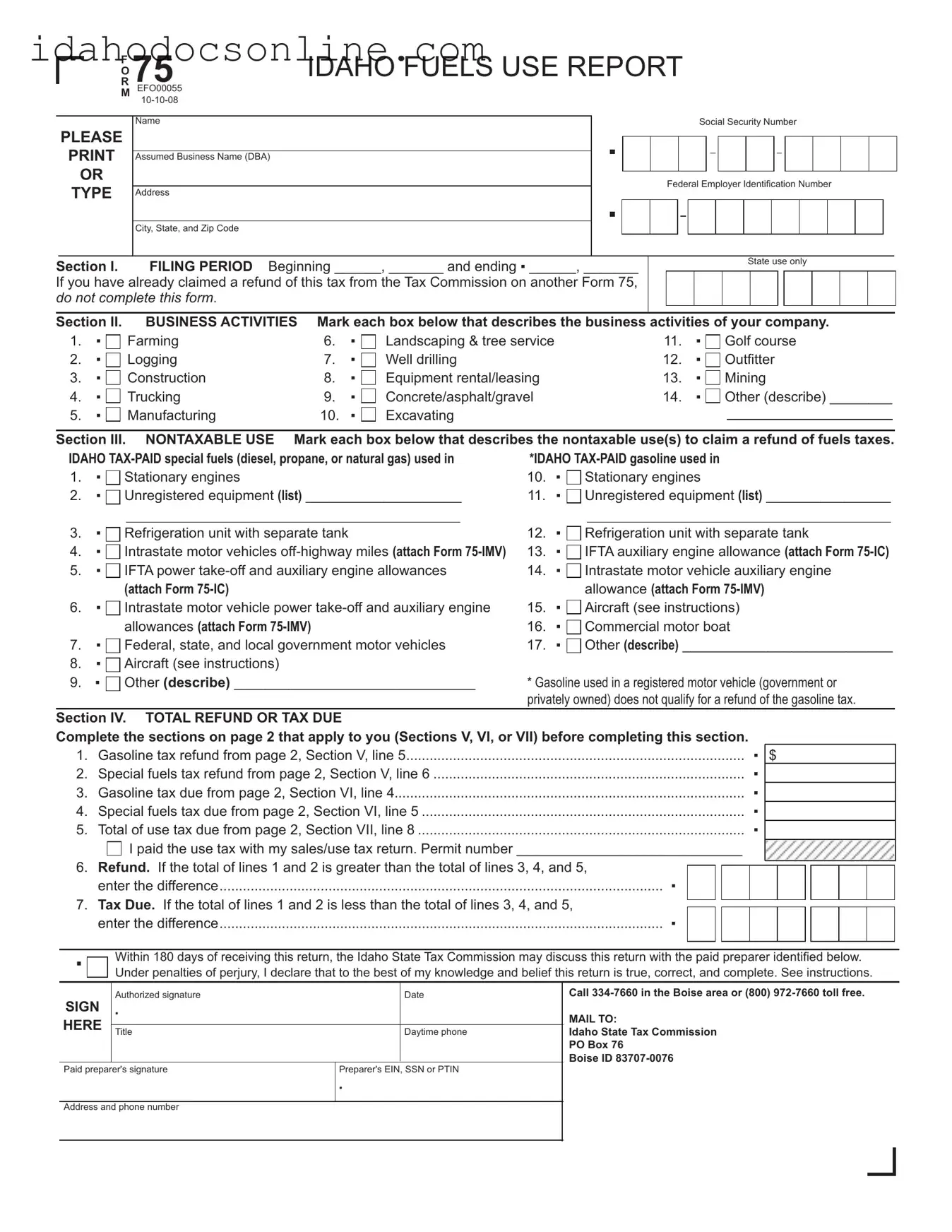

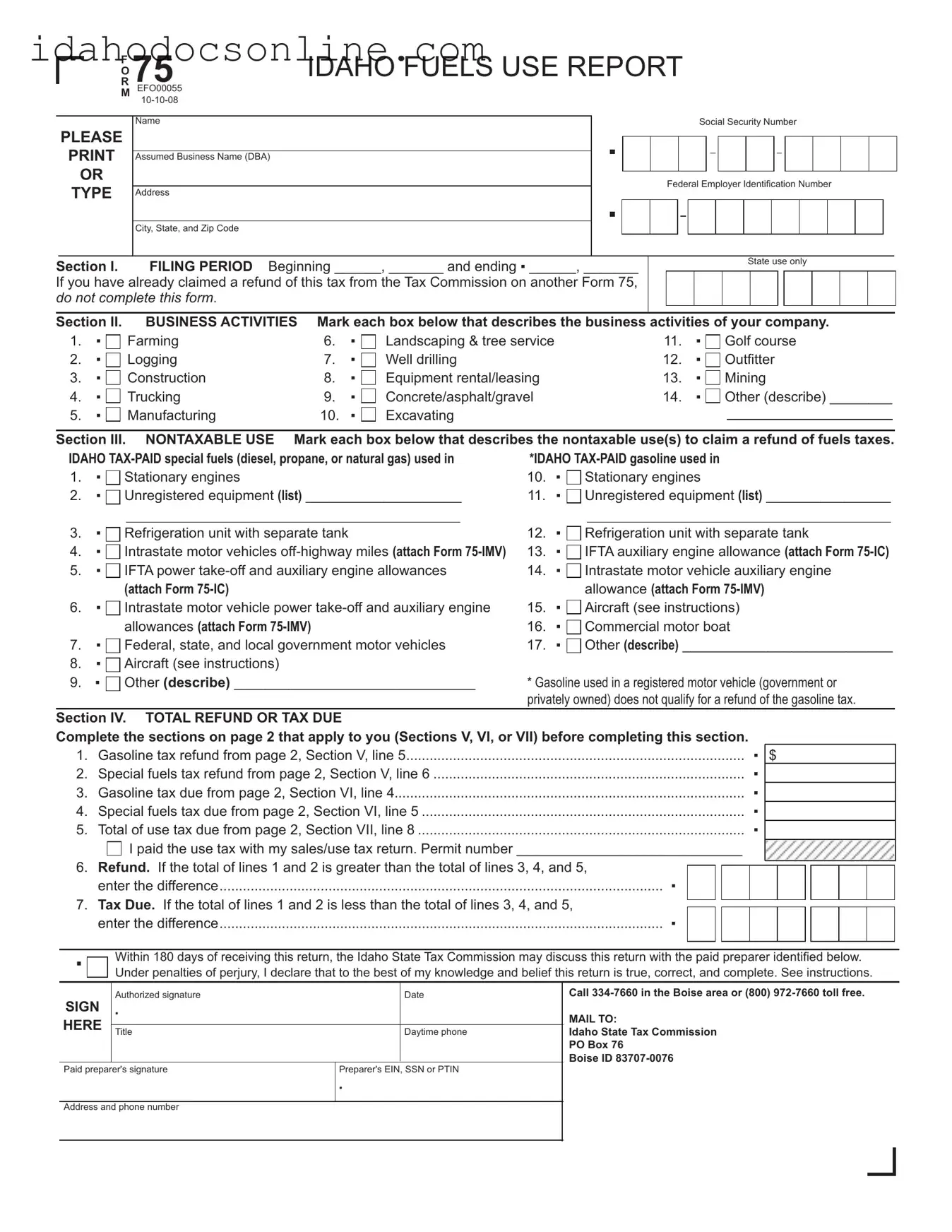

TAXPAyER INFORMATION

Enter name, assumed business name (DBA) (the name under which you are doing business), address, and Social Security number (SSN) or federal Employer Identiication Number (EIN).

If you are reporting as an individual or sole proprietor and

not as an S corporation, corporation, partnership, estate, or trust, you must use your SSN. DO NOT USE AN EIN.

yOU MUST PROVIDE THE INFORMATION REQUESTED FOR SECTIONS I, II, AND III TO RECEIVE A FUELS TAX REFUND. IF A FORM IS NOT COMPLETE, WE MAy RETURN IT TO yOU FOR CORRECTION.

FILING PERIOD

Section I. Enter the appropriate beginning and ending date for the iling period.

BUSINESS ACTIVITIES

Section II. Mark each box that describes the business activities of your company. If your company’s business activities are not described by any of the listed categories, mark the “Other” box and describe your company’s business activities.

NONTAXABLE USE

Section III. Mark each box that describes the nontaxable use(s) to claim a refund of fuels taxes. For unregistered equipment, list the type of equipment in the space next to the boxes. Attach additional pages if needed. If you have nontaxable use of fuel that is not described by any of the listed categories, mark the “Other” box and describe your nontaxable use.

ROUNDING AMOUNTS

Except for lines 2, 3, 4, and 5 of Section VII, round the amounts on this report to the whole gallon or dollar. Reduce amounts less than .50 to the whole gallon or dollar. Increase amounts of .50 or more to the next whole gallon or dollar.

FUELS TAX REFUND

If you use Idaho tax-paid fuel from a bulk storage tank for a nontaxable purpose, you must complete the

IDAHO FUELS TAX REFUND WORKSHEET.

Section V. Line 1. Enter the number of Idaho tax-paid gallons of fuel, from all sources, used during the iling period in the appropriate column by fuel type.

Line 2. Enter the number of Idaho tax-paid gallons of fuel used for a nontaxable purpose during the iling period in the appropriate column by fuel type. You must support your refund claim with documentation. See recordkeeping requirements section.

Line 4. Multiply line 2 by line 3 for each fuel type.

FUELS TAX DUE

Section VI. Line 1. Enter the number of untaxed gallons of fuel used for a taxable purpose during the iling period in the appropriate fuel type column. Round to the nearest whole gallon.

Line 3. Multiply line 1 by line 2 for each fuel type.

USE TAX DUE

Complete Section VII to report fuel USED on or after October 1, 2006, at 6%.

SPECIFIC LINE INSTRUCTIONS FOR SECTION VII You must separately calculate and report the USE TAX

Aircraft (see instructions)

Aircraft (see instructions)