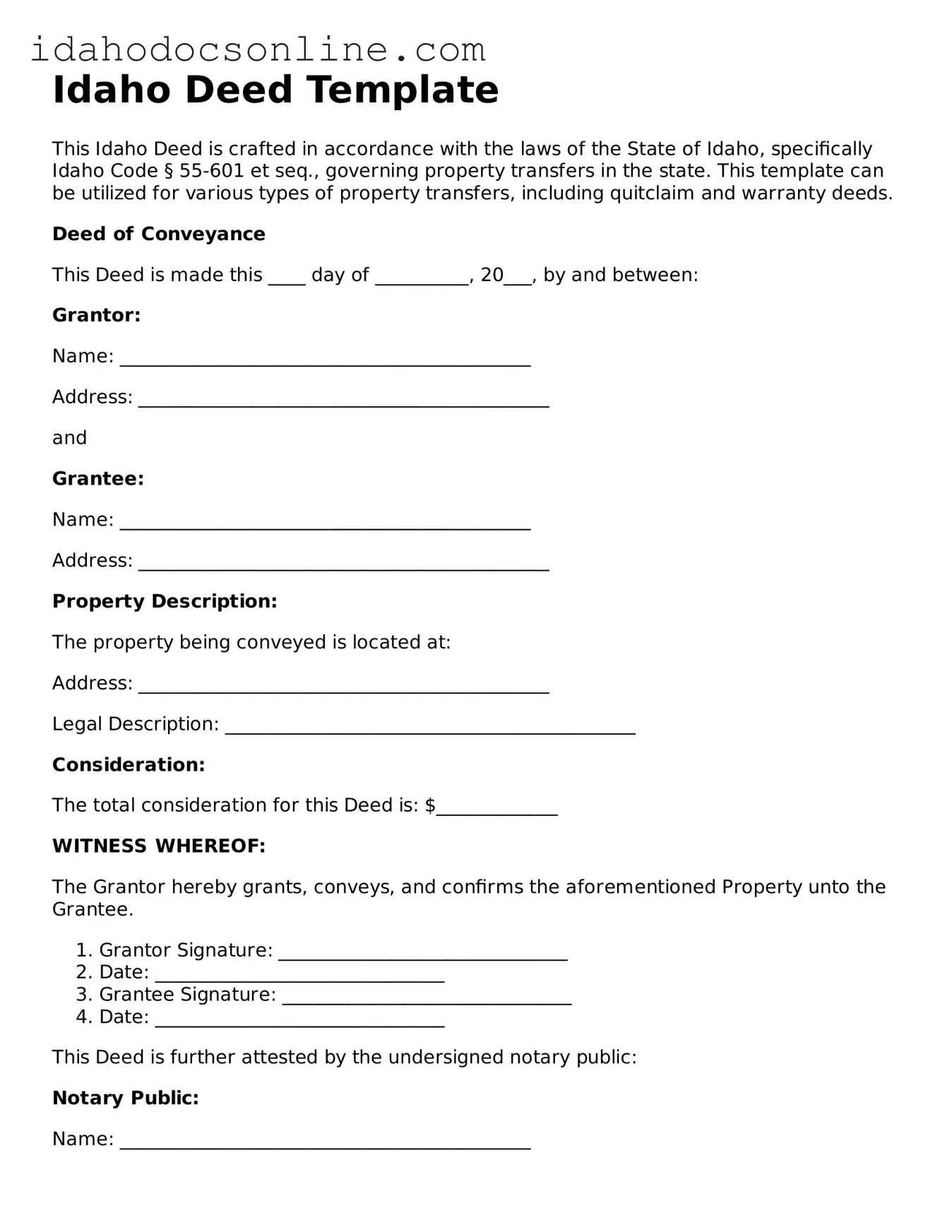

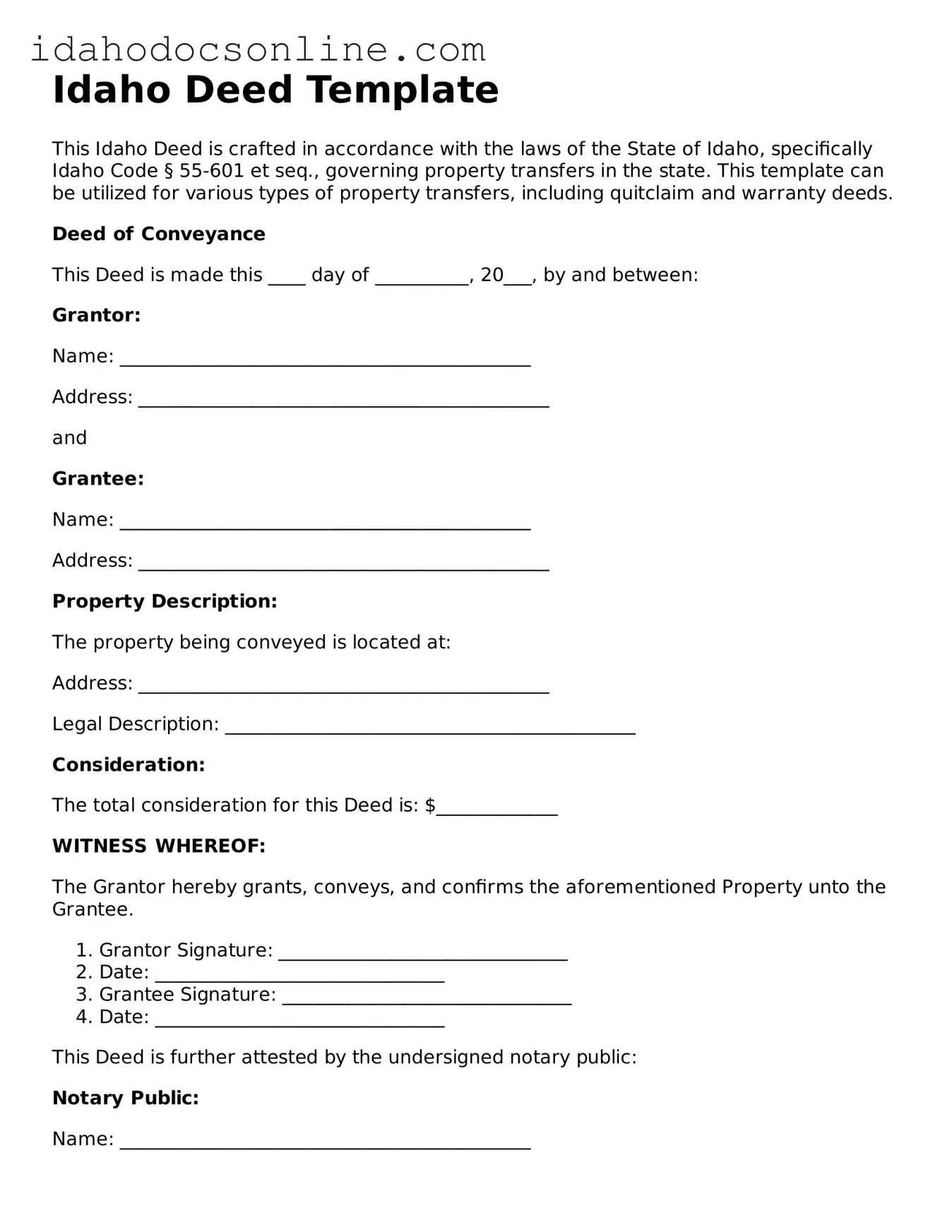

Free Deed Form for Idaho

A Deed in Idaho is a legal document that transfers ownership of real property from one party to another. This form serves as the official record of the transaction, ensuring that the new owner has clear title to the property. To begin the process of transferring property ownership, fill out the deed form by clicking the button below.

Fill Out Your Document

Free Deed Form for Idaho

Fill Out Your Document

Need speed? Complete the form now

Complete Deed online — edit, save, download with ease.

Fill Out Your Document

or

Free PDF