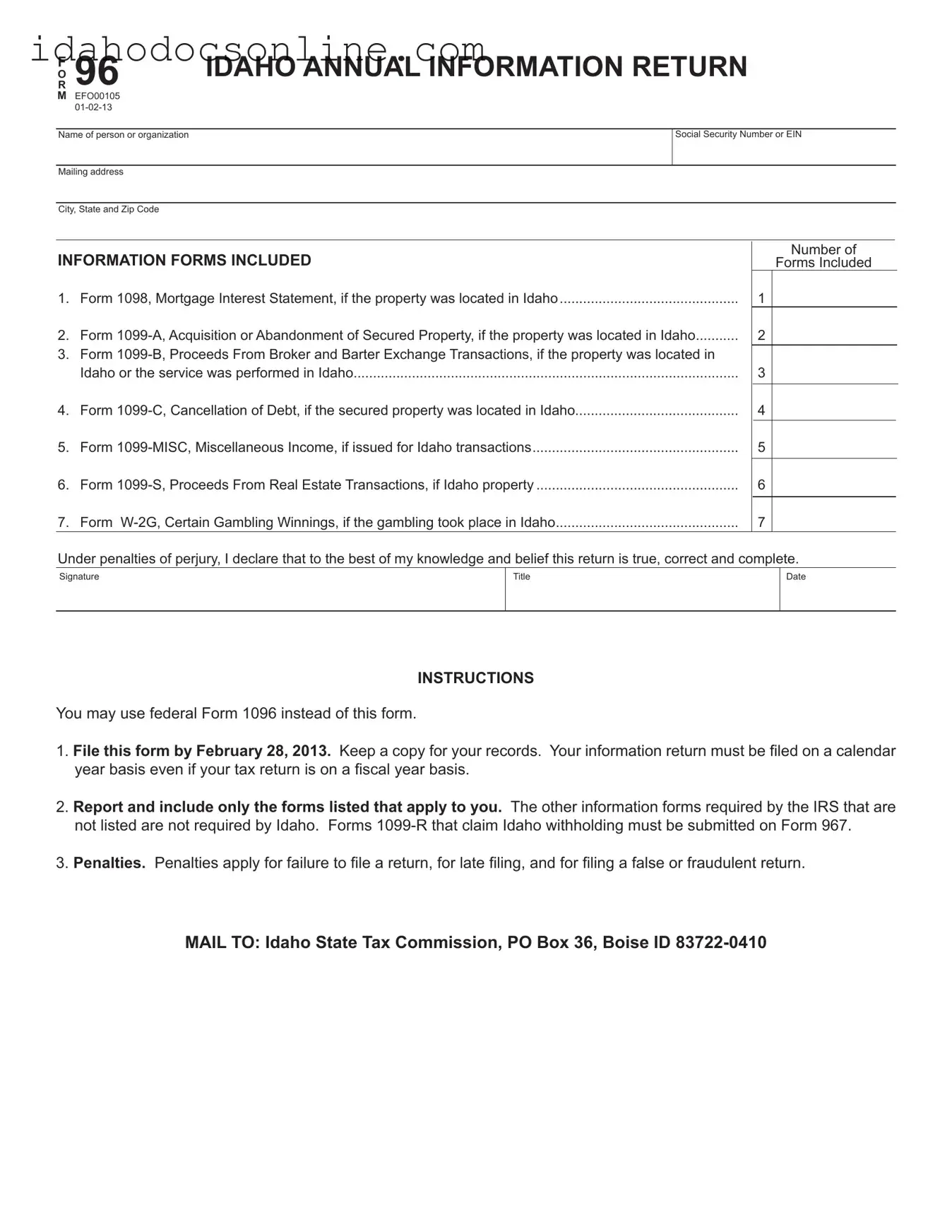

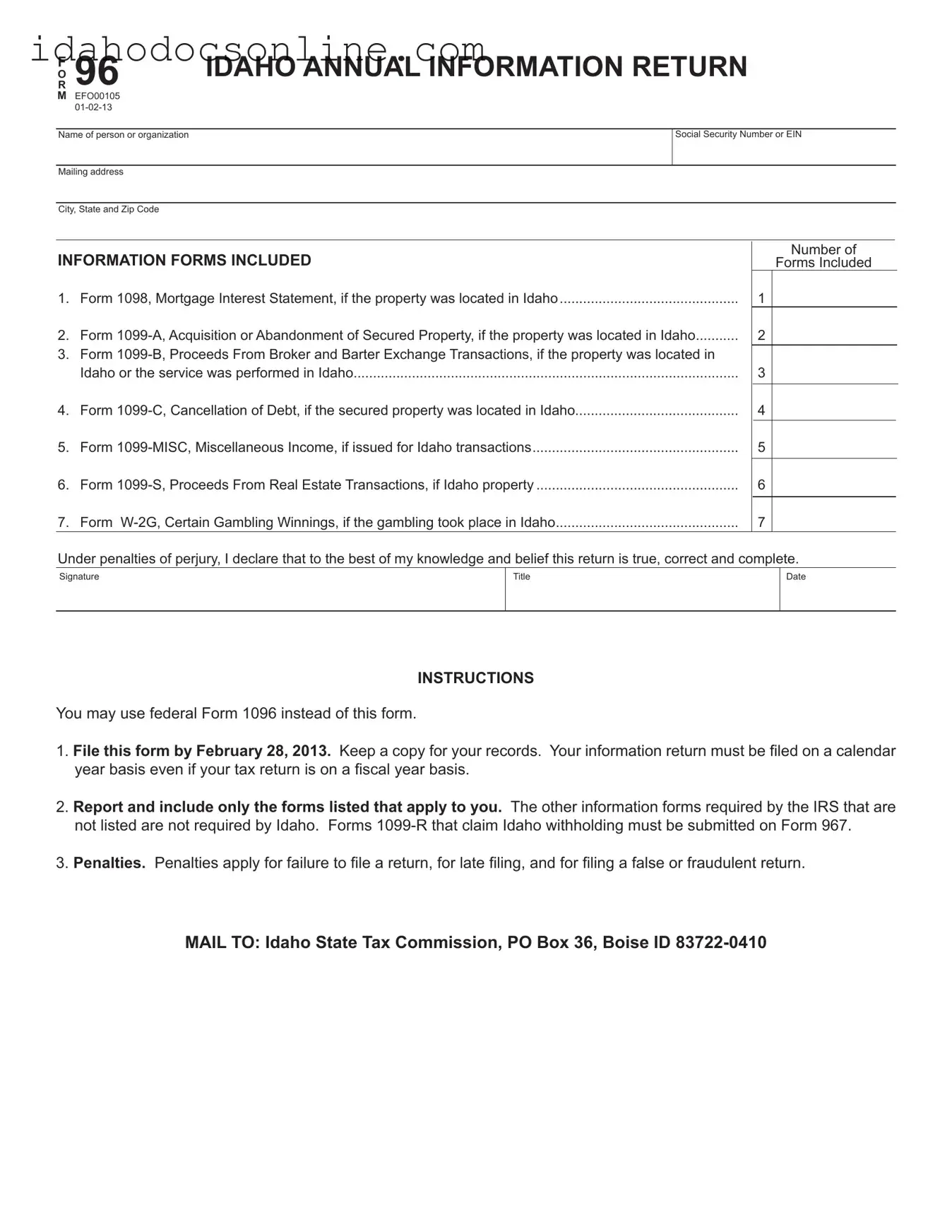

Blank 96 Idaho PDF Form

The 96 Idaho form is an annual information return used by individuals and organizations to report specific financial information to the Idaho State Tax Commission. This form includes various IRS forms such as 1098, 1099, and W-2G, which pertain to transactions and income related to properties and activities in Idaho. Make sure to fill out the form accurately and submit it by the deadline to avoid any penalties; click the button below to get started.

Fill Out Your Document

Blank 96 Idaho PDF Form

Fill Out Your Document

Need speed? Complete the form now

Complete 96 Idaho online — edit, save, download with ease.

Fill Out Your Document

or

Free PDF