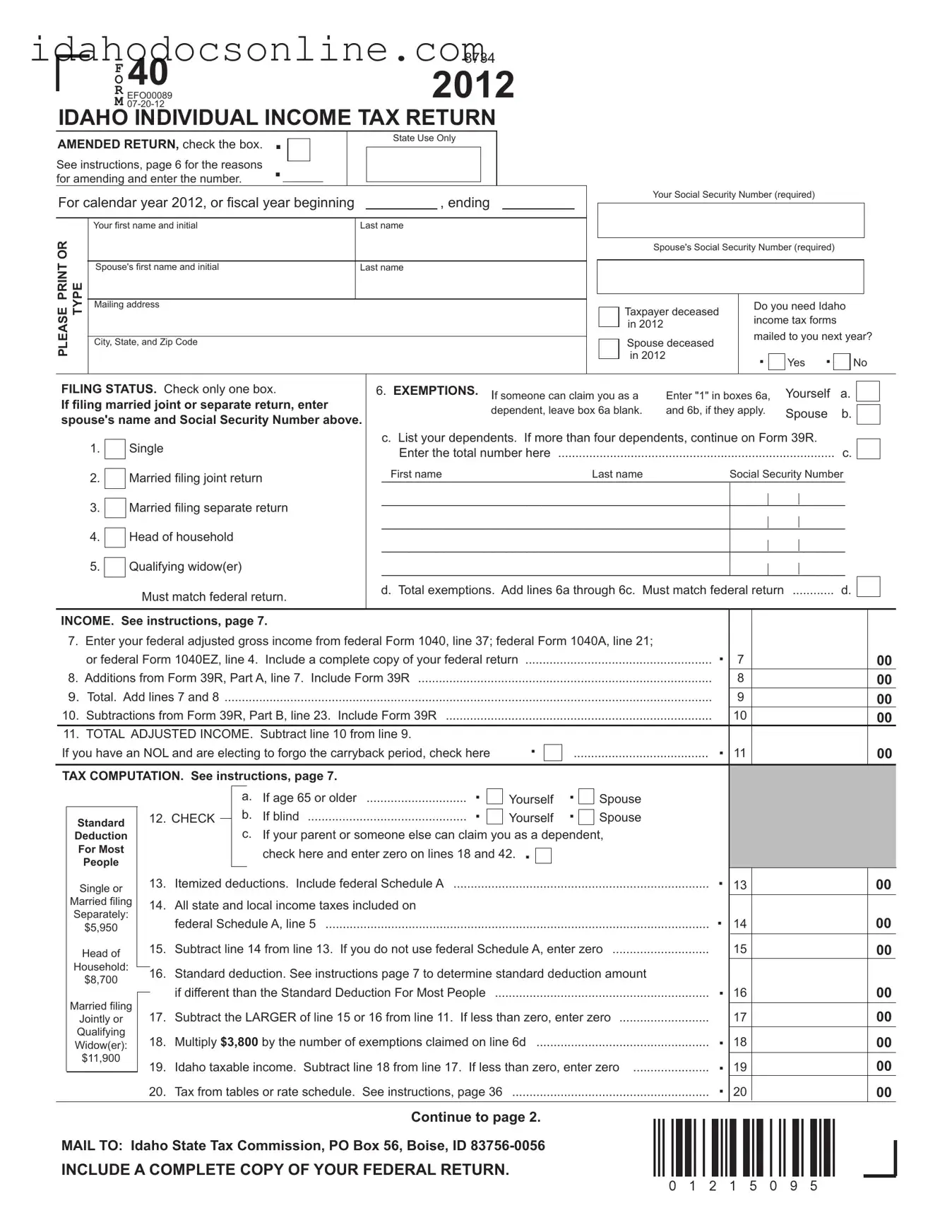

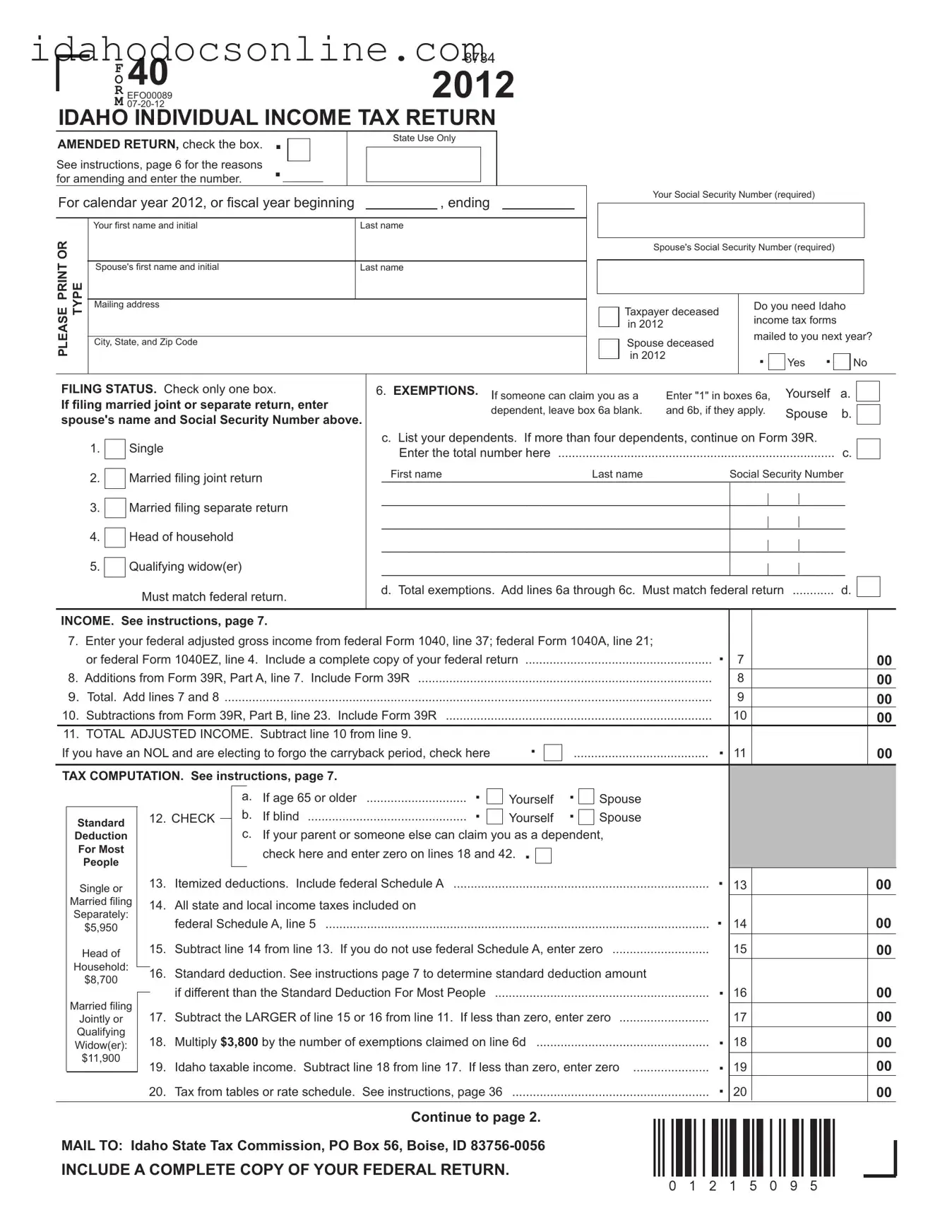

FILING STATUS. Check only one box. |

|

6. EXEMPTIONS. |

If someone can claim you as a |

Enter "1" in boxes 6a, |

Yourself |

a. |

|

|

|

|

|

|

|

|

|

If iling married joint or separate return, enter |

|

|

|

|

|

|

dependent, leave box 6a blank. |

and 6b, if they apply. |

Spouse |

b. |

|

|

|

|

|

|

|

|

spouse's name and Social Security Number above. |

|

|

|

c. List your dependents. If more than four dependents, continue on Form 39R. |

|

|

|

|

|

|

|

1. |

|

|

Single |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter the total number here |

|

|

|

|

|

|

|

c. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

Married iling joint return |

|

|

First name |

|

|

|

Last name |

|

Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

Married iling separate return |

|

___________________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

___________________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

Head of household |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

___________________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

Qualifying widow(er) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

___________________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Must match federal return. |

|

d. Total exemptions. Add lines 6a through 6c. Must match federal return |

............ |

|

d. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME. See instructions, page 7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. Enter your federal adjusted gross income from federal Form 1040, line 37; federal Form 1040A, line 21; |

|

|

|

|

|

|

|

|

|

|

|

|

|

or federal Form 1040EZ, line 4. |

Include a complete copy of your federal return |

. |

7 |

|

|

|

|

|

|

|

00 |

|

8. Additions from Form 39R, Part A, line 7. Include Form 39R |

|

|

|

|

8 |

|

|

|

|

|

|

|

00 |

9. |

Total. Add lines 7 and 8 |

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

00 |

10. |

Subtractions from Form 39R, Part B, line 23. |

Include Form 39R |

|

|

|

|

10 |

|

|

|

|

|

|

|

00 |

11. TOTAL ADJUSTED INCOME. Subtract line 10 from line 9. |

. |

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

If you have an NOL and are electing to forgo the carryback period, check here |

|

|

|

11 |

|

|

|

|

|

|

|

00 |

|

....................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX COMPUTATION. See instructions, page 7. |

|

|

Yourself . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. |

If age 65 or older |

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. CHECK |

|

|

b. |

If blind |

|

Yourself . |

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

Standard |

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deduction |

|

|

|

|

|

|

|

|

If your parent or someone else can claim you as a dependent, |

|

|

|

|

|

|

|

|

|

|

|

|

For Most |

|

|

|

|

|

|

|

|

|

|

check here and enter zero on lines 18 and 42. . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

People |

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

Single or |

|

13. |

..........................................................................Itemized deductions. Include federal Schedule A |

|

|

|

13 |

|

|

|

|

|

|

|

00 |

|

Married iling |

14. |

All state and local income taxes included on |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Separately: |

|

|

|

|

|

federal Schedule A, line 5 |

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

00 |

|

|

$5,950 |

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

Head of |

|

15. |

Subtract line 14 from line 13. |

If you do not use federal Schedule A, enter zero |

15 |

|

|

|

|

|

|

|

00 |

|

Household: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. Standard deduction. See instructions page 7 to determine standard deduction amount |

. |

|

|

|

|

|

|

|

|

|

|

|

|

$8,700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Married iling |

|

|

|

if different than the Standard Deduction For Most People |

|

|

|

|

16 |

|

|

|

|

|

|

|

00 |

|

|

|

|

.............................................................. |

|

|

|

|

|

|

|

|

|

|

17. |

Subtract the LARGER of line 15 or 16 from line 11. If less than zero, enter zero |

|

17 |

|

|

|

|

|

|

|

00 |

|

|

Jointly or |

|

|

. |

|

|

|

|

|

|

|

|

Qualifying |

|

|

18. |

Multiply $3,800 by the number of exemptions claimed on line 6d |

|

18 |

|

|

|

|

|

|

|

00 |

|

Widow(er): |

|

|

|

|

|

|

|

|

|

|

|

|

$11,900 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

...................... |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19. |

Idaho taxable income. Subtract line 18 from line 17. If less than zero, enter zero |

19 |

|

|

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. |

Tax from tables or rate schedule. See instructions, page 36 |

20 |

|

|

|

|

|

|

|

00 |